Teams collect data. Analysts compile it into slide decks. Leadership reviews it once a quarter. But reports arrive too late.

Most competitive monitoring efforts produce one thing consistently: reports nobody acts on. Meanwhile, a rival quietly drops prices, a new entrant redefines the value proposition, or a platform player bundles your product into irrelevance.

By the time the next report lands, the market has already moved.

A competitor radar fixes this. It's a structured approach that organizes competitive signals, assigns ownership, and feeds directly into business strategy. Not another market research exercise. A working system.

This article is your step-by-step guide to building one.

When competitive intelligence delivers no business value

Most organizations already do some form of competitor analysis. The problem isn't effort, but it's structure.

Four failure patterns explain why competitive intelligence rarely changes anything.

No ownership

Competitive monitoring without a clear owner becomes everyone's vague responsibility and nobody's actual job:

-

Marketing thinks the sales team tracks it.

-

Strategy thinks marketing handles it.

-

Meanwhile, signals go unnoticed.

Assign one person or team to own the competitor radar.

They collect, synthesize, and escalate. Everyone else contributes and consumes. Without this, competitive intelligence stalls before it reaches decision-makers.

No integration

Competitive data collected in isolation dies in isolation. If your competitor analysis lives in a separate tool, a shared drive folder, or an analyst's inbox, it won't reach the people making product, pricing, or positioning decisions.

Intelligence only delivers value at the point of decision.

Integrate competitor data directly into planning workflows, product reviews, and campaign cycles. That's when competitive analysis becomes actionable insights.

Episodic, not continuous

Quarterly reviews are too slow for fast-moving markets. By the time you've compiled a competitive analysis, the pricing strategy you're benchmarking has already changed. New competitors enter. Market trends shift. Competitive positions move.

Continuous monitoring replaces periodic snapshots with live signal tracking.

You detect when a direct competitor shifts positioning, not six weeks after they've done it.

Manual

Manual competitor analysis doesn't scale. One person can monitor a handful of sources. No one can track patent filings, job postings, pricing pages, customer reviews, and press releases across dozens of competitors simultaneously.

Automate data collection. Reserve human judgment for synthesis and escalation.

Data collection is infrastructure. Insight is the product.

Building a competitor radar: A structured competitive analysis system

The radar metaphor is deliberate. Radar does both: it detects objects, but it also organizes them: by distance, by direction, by threat level. Your competitor radar should do the same.

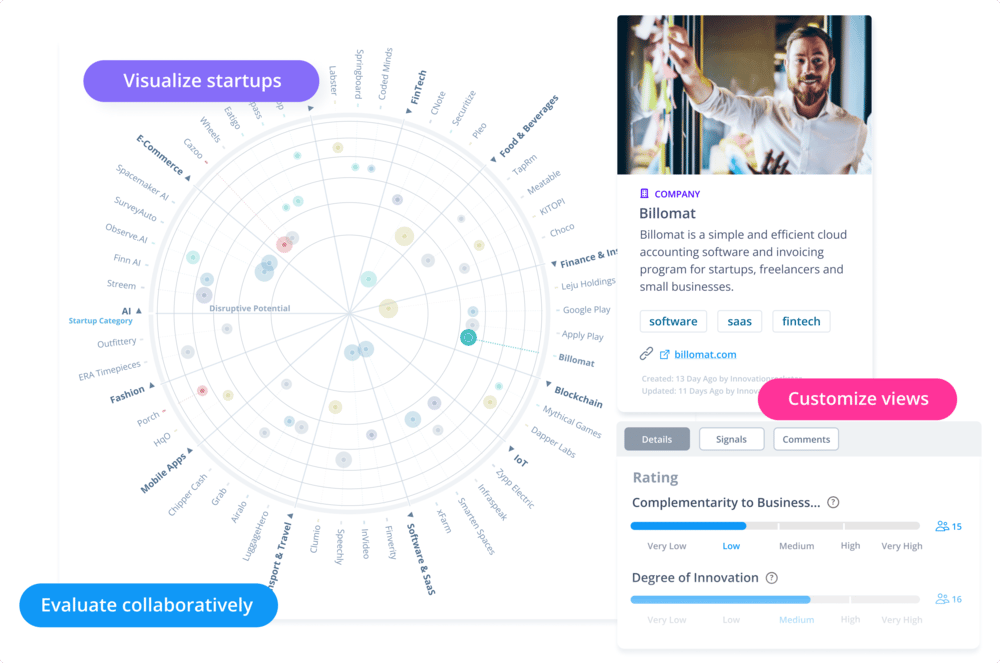

A well-structured competitor radar (Exhibit 1) has four organizing dimensions. Together, they turn scattered competitor analysis into a system that supports data-driven decisions.

Exhibit 1: The ITONICS startup radar gives you one shared view to scout, filter, and evaluate startups - faster and smarter.

Segments for orientation: Direct and indirect competitors

Not all competitors deserve the same attention or the same response. Segment them by how they compete for your target market.

Direct competitors sell similar products to the same target customers. They're the easiest to identify.

-

Your sales team already handles objections against them daily.

-

Their competitor strengths, competitor prices, and product features are visible.

-

Monitor their pricing changes and marketing efforts closely.

Indirect competitors solve the same customer problem through different means. A project management software company competes indirectly with consultants who solve planning problems through services instead of tools.

-

Indirect competitors don't beat your product features.

-

They make your features irrelevant by changing what potential customers value.

Ecosystem threats emerge from adjacent industries. They're invisible until they're existential.

-

When Amazon entered cloud services, traditional IT vendors didn't see the threat coming.

-

When platforms bundle capabilities your product charges for, your competitive edge erodes fast.

Place each competitor in one of these three segments to define their position on the radar:

-

Direct competitors shape your next quarter.

-

Indirect competitors and ecosystem threats shape the next three years.

Large and small companies compete on different dimensions. Small companies often move faster as they test new product features, shift pricing structures, and enter niche markets before incumbents notice. Thus, monitoring only established players in your target market creates blind spots.

Business owners in adjacent categories are often the first to redefine a market. A brand reputation built on trust and quality can shift competitive positions faster than any pricing move. Therefore, always track both.

Distance for need of action

Not every signal requires the same speed of response. Therefore, the distance on the radar represents urgency.

Competitors in the inner ring require immediate attention: price drops above 15%, product launches that address your core value proposition, major customer wins visible through public case studies, or social media.

Competitors in the middle ring require regular monitoring: feature updates, hiring patterns signaling new strategic bets, and positioning shifts in their marketing strategy.

Competitors in the outer ring require periodic review: emerging players, adjacent market entrants, and technology shifts that could eventually reshape competitive positions across the industry.

Set escalation triggers:

-

If a direct competitor drops prices by more than 15%, alert the sales team within 24 hours.

-

If an indirect competitor launches a feature that overlaps with your roadmap, escalate to product leadership the same day.

Define the triggers in advance so responses aren't improvised under pressure.

Colors for risk

Colors give your team instant situational awareness without reading a full report.

Use a simple three-color system:

- Red: Immediate competitive threat. Requires a strategic response within days or weeks.

- Yellow: Developing threat or monitoring signal. Requires tracking but not immediate action.

- Green: Stable. No significant competitive movement detected.

Review and update color classifications in every monitoring cycle. A yellow competitor that secures major funding and begins scaling online advertising can turn red overnight. Consistent color reviews keep the competitive landscape accurate.

Size of relevance

Not every competitor has equal influence on your market. Size on the radar reflects relevance to your competitive strategy.

Relevance isn't just revenue or market share. A small startup with a differentiated value proposition targeting your most valuable customer segment is more relevant than a large player competing in adjacent verticals you don't serve.

Assess relevance based on: degree of overlap with your target audience, speed of competitive movement, and ability to outspend or outmaneuver you in key areas. Use this assessment to guide where your competitive analysis goes deep and where it stays lightweight.

Three rules for building a competitor analysis framework that drives business growth

The radar structure gives you a framework. These three rules determine whether teams actually use it to support business development and strategic planning.

Rule 1: Define the purpose of your market research radar

A competitor radar built for strategic planning looks different from one built for sales enablement. Define the primary purpose before you set up anything else.

Ask: What decisions should this radar inform? Pricing strategy? Campaign positioning? Product line expansion? Marketing automation investments?

The answer determines

-

which competitors you track,

-

which signals matter, and

-

how frequently you need updates.

A radar serving product teams needs feature-level competitor analysis.

A radar serving the sales team needs competitive messaging and win/loss patterns.

A radar serving strategy needs industry analysis and market trends. Conflating all three creates noise that nobody acts on.

Write a one-page charter for the radar. State the primary purpose, the decisions it informs, and what good output looks like. Get stakeholder sign-off. This prevents scope creep and keeps the system focused on business growth.

Rule 2: Set up a collaborative infrastructure for analyzing industries

Competitive intelligence trapped in one person's head or one team's folder doesn't become a business strategy. It becomes a bottleneck.

Build shared infrastructure where multiple teams contribute signals and access insights. This is how analyzing industries becomes a company-wide capability rather than a side project.

- The sales team contributes win/loss data and field intelligence from the sales process.

- Product contributes feature comparisons and roadmap overlap analysis, including a SWOT analysis of key competitors.

- Marketing contributes to positioning analysis, ad creative monitoring, and competitor website tracking.

- Business development contributes to partnership announcements and ecosystem movement.

With no conflicting data and no outdated battle cards, you can reach one source of truth.

Primary research with customers strengthens this further. Customer conversations reveal what competitor strengths actually matter to buyers versus what your internal competitor analysis assumes.

Rule 3: Define team responsibilities and reporting cadence

Different signals need different monitoring frequencies. Treating everything as urgent creates alert fatigue. Treating everything as routine guarantees missed threats.

Daily: Competitor website changes (especially pricing pages and product features), social media sentiment spikes, major news announcements.

Weekly: Competitor blog posts and content releases, job postings signaling strategic bets, customer review aggregate shifts, press releases, and search engine optimization ranking shifts.

Monthly: Product update releases, trade publication coverage, annual reports and financial disclosures, patent publications.

Quarterly: Strategic partnership announcements, positioning changes, organizational restructuring, full competitor analysis refresh, market analysis update.

Assign explicit owners for each cadence. Each monitoring segment needs a responsible person with defined tasks:

- Direct competitors: Product and marketing own weekly feature and messaging reviews. The sales team owns win/loss data collection after every competitive deal.

- Indirect competitors: Strategy or innovation teams own monthly reviews, watching for value proposition shifts and emerging substitutes.

- Ecosystem threats: Strategy owns quarterly reviews, scanning adjacent industries and platform players for forward integration signals.

Routine for using competitive intelligence to sharpen your marketing strategy

A competitor radar is only as good as the habits built around it. The structure tells you what to track. Routines determine whether insights reach product, R&D, and innovation decisions.

Define the purpose before you define the process

A competitor radar built for R&D planning looks different from one built for marketing efforts. Define the primary purpose before you configure anything.

If the radar serves innovation and R&D teams, the most important signals are patent filings, technology partnerships, R&D hiring patterns, and conference activity. A competitor hiring a VP of AI signals a capability investment 12 to 18 months before a product launch. A patent cluster in a technology area your roadmap depends on is a strategic threat, not a footnote.

If the radar primarily serves business strategy and portfolio planning, the signals shift toward market share movements, pricing structure changes, and competitive positions across segments.

Most organizations need both. The mistake is building one system and assuming it serves all audiences equally. Define the primary use case. Then configure the signals, cadences, and owners accordingly.

Set up a collaborative infrastructure for analyzing industries

Competitive intelligence trapped in one team's folder doesn't become strategy. It becomes a bottleneck.

-

R&D teams surface technology signals.

-

Innovation teams track emerging market trends and new entrants.

-

Strategy teams track competitive positions and market analysis.

-

Marketing efforts reveal how competitors are positioning their value proposition externally.

Each team sees a different part of the competitive landscape.

Build shared infrastructure where all of these signals converge.

-

When R&D flags a competitor patent, the strategy needs to see it.

-

When marketing detects a positioning shift in promotional strategies or messaging, product and innovation teams need to know.

Industry analysis only becomes actionable insights when the right people receive the right signals at the right time.

Use primary research with customers to strengthen what the radar detects. Customer conversations reveal which competitor strengths actually influence buying decisions versus what internal analysis assumes.

Define team responsibilities and regular tasks

Each monitoring segment needs a named owner with explicit tasks. Without named owners, the radar decays within a quarter.

- Direct competitors: Product and R&D teams own monthly feature and technology reviews. Track product features, patent filings, and capability announcements. The sales team owns win/loss data after every competitive deal.

- Indirect competitors: Innovation teams own monthly reviews. Watch for value proposition shifts, new entrants redefining the target market, and substitute technologies gaining traction.

- Ecosystem threats: Strategy owns quarterly reviews. Scan adjacent industries, platform players, and technology providers for signs of forward integration into your market.

Rotate ownership only deliberately. Frequent changes break institutional knowledge and monitoring continuity.

Define reporting cadence and escalation paths

Different signals need different monitoring frequencies. Treating everything as urgent creates alert fatigue. Treating everything as routine guarantees missed threats.

Daily: Competitor website changes, social media announcements, major news.

Weekly: Job postings signaling strategic bets, press releases, customer review shifts, search engine optimization ranking changes for key terms.

Monthly: Product release notes, trade shows coverage, patent publications, competitor websites updates, annual reports, and financial disclosures.

Quarterly: Full competitive landscape review, market analysis update, strategic planning alignment, portfolio prioritization based on updated competitive positions.

Each cadence level must connect to a specific decision.

-

Weekly signals connect to sales team responses and marketing efforts adjustments.

-

Monthly reviews connect to R&D prioritization and roadmap decisions - tracking how competitors' tactics evolve reveals strategic priorities months before they announce them.

-

Quarterly reviews connect to portfolio strategy and resource allocation.

Without defined escalation paths, competitive intelligence stops at the analyst. It never reaches the innovation or R&D teams who can act on it.

How ITONICS enables real-time competitive intelligence for innovation and R&D teams

Building a competitor radar manually means managing scattered tools, inconsistent contributions, and constant overhead. The infrastructure becomes a bottleneck before intelligence reaches anyone who can use it.

ITONICS is built specifically for the organizations where competitive advantage lives in R&D pipelines, innovation portfolios, and technology positioning, not just in sales and marketing.

Intelligence integrated with innovation and strategic planning workflows. ITONICS embeds competitive data directly into innovation management and strategic planning processes.

-

When R&D teams review technology roadmaps, competitive intelligence sits alongside market research and patent data in the same environment.

-

When innovation teams assess their portfolio, competitor moves are visible in context, not buried in a separate report.

Strategic analysis and execution happen in one place.

Automated collection of weak signals and technology trends. The platform continuously aggregates signals from news feeds, patent databases, scientific publications, market research reports, and custom sources. It pushes relevant updates to the right stakeholders based on the competitor segments and escalation triggers you define.

-

When a competitor files a patent overlapping your R&D roadmap, the system flags it.

-

When pricing changes or capability announcements occur, affected teams see it immediately.

R&D and innovation teams focus on interpretation, not data collection.

Collaborative infrastructure across R&D, innovation, strategy, and marketing efforts. Innovation teams share technology scouting insights. R&D flags patent and capability releases. Strategy contributes to market analysis and tracking competitive positions. Marketing efforts surface how competitor messaging is shifting externally. Business development notes partnerships and ecosystem moves. Everyone feeds the same competitive landscape. No conflicting data. No outdated intelligence. One source of truth.

For R&D and innovation leaders, this is the difference between a competitor radar that sits in a slide deck and one that shapes what you build, when you invest, and where you focus next.

Companies that consistently gain market share don't have better products. They have better systems for detecting when their competitive edge is eroding and responding before erosion becomes a crisis.

FAQs on building competitor radars

How many competitors should be on a competitor radar?

Track enough to cover all three archetypes: direct competitors, indirect competitors, and ecosystem threats.

For most companies, this means 5 to 15 direct competitors, 3 to 8 indirect competitors, and a watch list of 5 to 10 ecosystem threats. Prioritize depth over breadth. Shallow tracking of 30 competitors misses more than deep tracking of 15.

Who should own the competitor radar?

Ownership depends on how the radar is used.

-

If it primarily informs product decisions, product management should own it with marketing contributing.

-

If it primarily informs business strategy, the strategy team owns it.

Whoever owns it must have the authority to escalate findings to the right decision-makers and connect competitive intelligence to real resource allocation.

How often should competitor radar classifications be reviewed?

Do a full reclassification quarterly. Update color ratings in real time when significant events trigger escalation. Segment classifications should change only when a competitor's behavior fundamentally shifts, not based on individual signals.

What's the difference between a competitor radar and a competitive analysis report?

A competitive analysis report is a point-in-time document. A competitor radar is a continuous system.

Reports document what happened. A radar detects what's happening and triggers responses before it's too late to act. The radar enables competitive strategy. The report only describes it.

How do you prevent a competitor radar from becoming outdated?

Assign explicit maintenance tasks to team members with defined cadences. Build update reviews into recurring meeting agendas.

Automate data collection at the signal level using tools that monitor competitor websites, Google Search results, and industry publications. If updating the radar depends on someone remembering to do it, it will decay.