Startups don’t wait. So why is your scouting stuck in last year’s spreadsheet? If you’re still relying on decks, reports, and ad hoc research, you’re already behind. A startup radar helps you track the right signals—and move when it counts.

Innovation leaders don’t need more info—they need clarity. A startup radar gives you the visibility and structure to monitor emerging companies, spot strategic opportunities, and align external innovation with internal priorities. This isn’t about playing VC. It’s about spotting tomorrow’s advantage before your rivals do.

Let’s break it down.

Why a startup radar beats scattered scouting

You don’t need more startup lists—you need a system. One that helps you filter, focus, and act. A startup radar gives you an interactive visual overview of companies by relevance, maturity, and strategic fit.

The best radars integrate trends, technologies, and startup signals—so you see not just who’s out there, but why they are relevant in your industry.

What makes a startup radar valuable

Map your ecosystem

Use the radar to build a live portfolio of early stage startups, organized by themes, technologies, or business units. Include trend relevance, patent data, funding stage, and more.

Cut through the noise

Filter by location, maturity, funding, technology tags, or round. Looking for new startups working on urban delivery robots using AI and next-gen batteries? You can narrow it down in seconds.

Connect insights across teams

No more locked-up PDFs or lost scouting decks. Share startup profiles with your engineering, product, and business development teams—all one one platform.

Plan, partner, act

A good startup radar helps you move from insight to action. Track relationships, identify gaps in your portfolio, and prioritize engagement—whether it’s a pilot project, joint venture, or investment.

Best practice example: DZ Bank

Germany’s second-largest financial institution, DZ Bank, monitored the fintech landscape to understand the changes in the value chain within the banking industry. The Fintech Radar with a curated output on fintech startups helped the bank to gain a company-wide overview of all potential fintech cooperations. Based on predefined criteria of interest (e.g. customer benefit, earnings potential, suitability for the mass market), strategic evaluation of trends was conducted.

All the trends, technologies, and startups (external perspective) were visualized according to evaluation criteria in the Innovation Radar and mapped with the company’s internal innovation activities (internal perspective) to identify their strategic relevance.

As a result,

- a company-wide innovation radar was created as a single source of reference

- strategic fields of action and gaps of the innovation portfolio were identified

- a company-specific fintech module was integrated to monitor the market and the existing corporate-startup partnerships

- over 120 employees from various departments contributed to the project

How Unilever collaborates with new startups

In an episode of our Innovation Rockstars podcast, PJ Mistry from Unilever shared her hard-won lessons on startup collaboration. One key insight: sourcing new startups is only the beginning—the real challenge is navigating internal complexity to turn interest into action. From onboarding barriers to procurement hurdles, Mistry outlined how large organizations can rethink startup engagement as a cultural shift, not just a pipeline.

You can listen to the full episode: A Toolbox for Start-up and Corporate Collaboration

A better way to track startups with ITONICS

Scattered research means missed opportunities. One-off scouting means short-term wins—and long-term waste. And when teams don’t share what they see, you get blind spots in your innovation strategy.

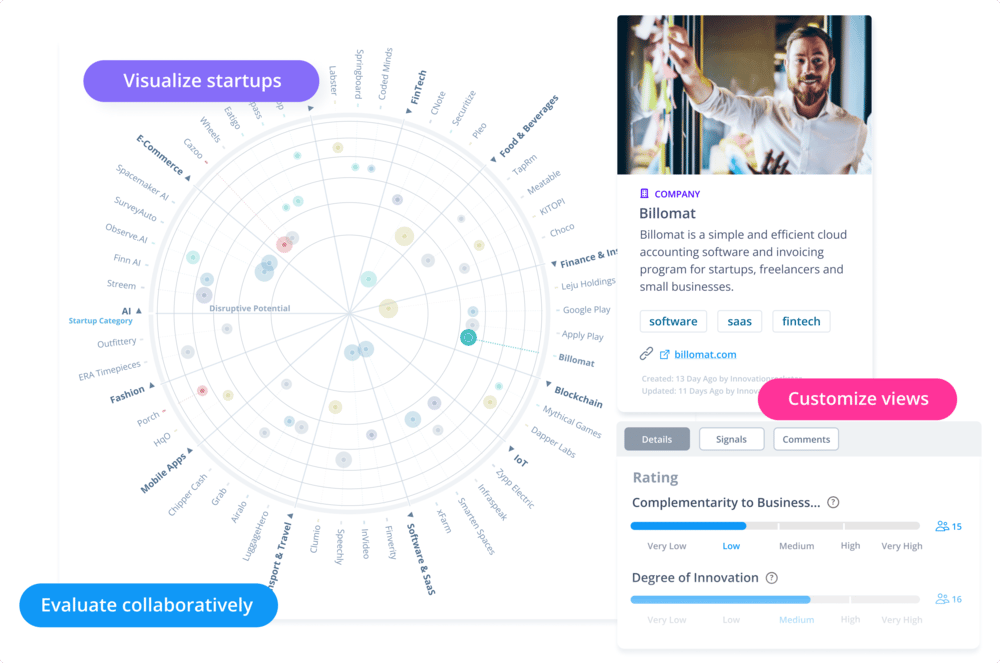

The ITONICS startup radar gives you one shared view to scout, filter, and evaluate startups—faster and smarter.

You can plot startups on the radar according to industry, the sort and filter by disruptive potential, funding round, maturity, geography, scouting phase, and more. The radar adjusts dynamically based on your setting, and each startup has a detailed profile with evaluation metrics—ready for cross-team review.

Need to find recently funded robotics startups in Poland using carbon fiber? Filter, spot, assess, and act—without jumping between spreadsheets, email threads, or slide decks.

The result: fewer missed bets, faster decisions, and clearer alignment across your R&D, product, and innovation teams.

To see how ITONICS can benefit your business, just book a demo with our experts.