Corporate innovation doesn't fail because companies can't find startups. It fails because they don’t know how to work with them. The winners aren’t the ones who scout fastest, but the ones who scale what they find.

Startup collaboration has evolved from optional to essential. With over 87% of Fortune 500 companies now running formal startup engagement programs, the focus has shifted from experimentation to execution.

The rapidly changing corporate landscape, shaped by technological, economic, and regulatory shifts, has made these partnerships crucial for staying competitive. Yet many still struggle to move beyond one-off pilots and showcase partnerships toward scalable, business-relevant outcomes.

Startup Relationship Management (SRM) is the strategic backbone of high-performing corporate-startup collaboration. It covers the full lifecycle - from intelligent scouting powered by AI to visualizing ecosystems with a Startup Radar, selecting the right partners, and orchestrating tailored engagement strategies.

Drawing on hard-won lessons from the field, we explore what separates successful SRM programs from those that stall: executive sponsorship, startup-friendly processes, a portfolio mindset, and transparent, measurable value creation.

Large companies and big corporations must adapt their traditional approaches to effectively collaborate with startups and unlock true innovation. A case study from Unilever illustrates how these principles work in practice.

The question is no longer whether to work with startups. It is whether an organization can work with them fast enough, and at scale, before competitors do.

The new reality of corporate-startup partnerships

The corporate-startup collaboration landscape has transformed dramatically over the past five years.

What was once a “nice-to-have” innovation strategy has become a business imperative, with 87% of Fortune 500 companies now running formal startup engagement programs, compared to just 62% in 2019.

The acceleration of digital transformation, combined with rapid advances in AI, sustainability mandates, and shifting market dynamics, has made partnership with agile startups essential for corporate survival. Embracing disruptive technologies such as AI, blockchain, and the metaverse is now crucial for companies to remain competitive in rapidly evolving markets.

Big corporations increasingly seek ways to team up with startups to gain a competitive edge and embrace the “digital native” way of working. Partnering with technology-driven startups makes corporates more agile, innovative, and able to respond quickly to market changes. These collaborations also foster an entrepreneurial mindset within large organizations, encouraging risk-taking, experimentation, and disruptive thinking.

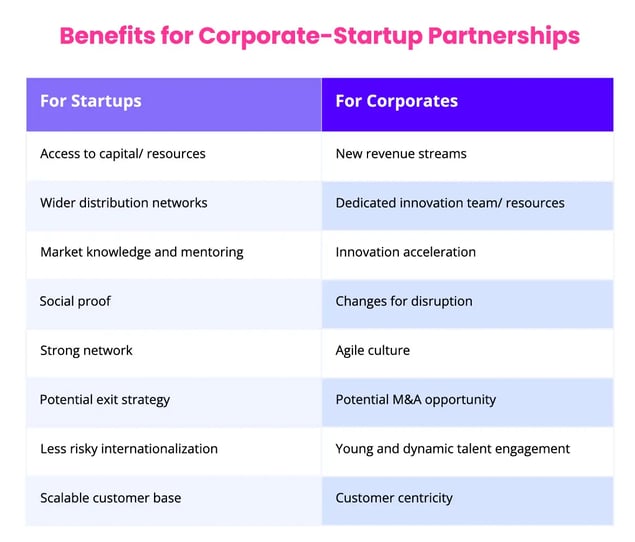

Startups, as an integral part of a company’s external innovation sources, are also increasingly looking to cooperate with big companies for greater market access, increased visibility and reputation, as well as wider distribution networks. These relationships provide mutual benefits (Exhibit 1) and can open up important channels of financial resources, such as corporate venture capital.

For startups navigating the challenging funding environment of recent years, corporate partnerships have become not just attractive but often essential for growth and survival. Importantly, these partnerships enable companies to move beyond incremental change and pursue more transformative, breakthrough innovation.

Exhibit 1: Benefits for corporate-startup partnerships

This gap between program prevalence and program effectiveness reveals a fundamental challenge: most organizations have recognized that startup engagement matters, but far fewer have mastered how to make it work.

This is precisely why implementing effective SRM is crucial for turning aspirations into outcomes. SRM is a comprehensive methodology for maintaining a company's relationships with the startup ecosystem and building a powerful and effective interface to partner with innovative newcomers

Usually, corporate SRM focuses on maintaining and automating startup scouting, visualizing relevant startups on a Startup Radar, improving the quality of startup recruitment, and managing ongoing partnerships through their entire lifecycle.

Is it worth implementing startup relationship management?

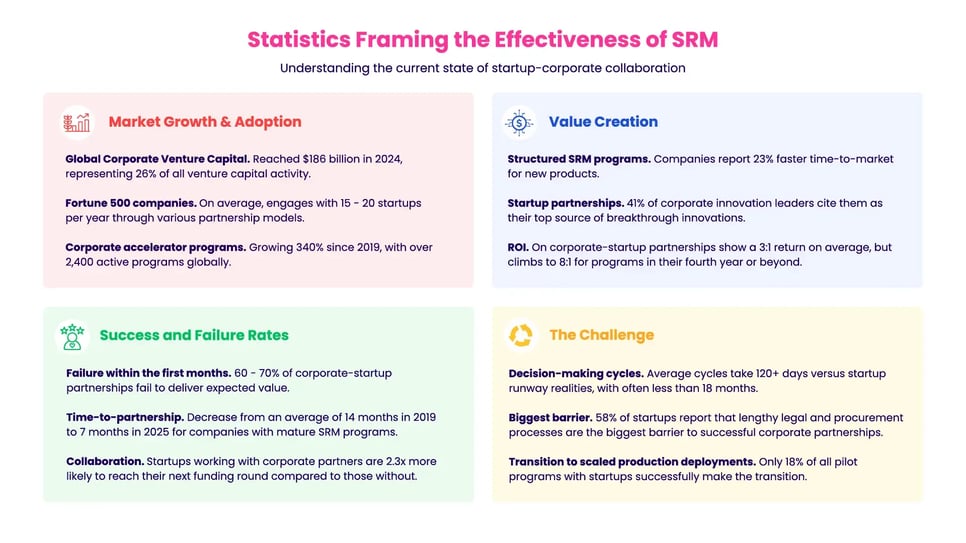

Understanding the current state of corporate-startup collaboration helps frame why effective SRM is critical. Therefore, the following statistics and numbers (Exhibit 2) might help gain a profound understanding.

Exhibit 2: Statistics framing the effectiveness of SRM

These statistics underscore once more a critical insight: having a startup program isn’t enough. Success requires systematic, strategic relationship management that addresses both the opportunities and the inherent challenges of corporate-startup collaboration.

Organizations that master SRM will access external innovation and fundamentally reshape their ability to sense market changes, respond to disruption, and create the future rather than react to it. By effectively managing multiple stakeholders - including external stakeholders such as startups, research institutions, and innovation hubs - SRM helps organizations unlock innovation potential and maximize the value of their open innovation initiatives.

In an era where competitive advantage increasingly comes from ecosystem orchestration rather than internal capabilities alone, SRM goes beyond an innovation tactic: it’s a strategic imperative.

Time to find a suitable collaboration partner

With over 1.3 million active startups globally and hundreds of new companies launching daily, the discovery challenge is both overwhelming and crucial. Among this influx of new startups, identifying the most promising startups for partnership or investment becomes a significant challenge.

The difference between systematic startup discovery and ad-hoc searching can mean the difference between finding transformative partners before competitors do or missing them entirely.

Modern startup discovery is no longer about attending demo days and hoping the right opportunity walks through the door. It’s about deploying intelligent systems that can scan thousands of potential partners, identify strategic fit, and surface opportunities aligned with your innovation priorities.

These systems enable organizations to gain access to innovative solutions, emerging technologies, and new markets by connecting with the right startups. Therefore, the critical question becomes: where does an organization need to start?

Fast startup discovery in the AI era

Startup scouting is a decisive element for bringing external innovations to any organization. At the scouting stage, companies try to spot the startups that might disrupt their industry or business model, and startups that use new technologies to address existing challenges.

Modern startup scouting has evolved far beyond manual research and database queries. What once required teams of analysts spending weeks on desk research can now be accomplished in hours through intelligent automation. Today’s leading SRM platforms leverage:

Generative AI & Large Language Models. AI can now process thousands of startup profiles in minutes, extracting key insights about technology stacks, business models, and competitive positioning that would take human analysts weeks to compile. These insights can inform product development and guide innovation projects by identifying trends and opportunities for collaboration.

Predictive Analysis. Predictive models can forecast which early-stage startups are likely to become category leaders based on patterns observed in previous successful ventures. Collaboration with venture capitalists can further enhance the identification of high-potential startups by leveraging their funding expertise, strategic insights, and networks.

Multi-source Intelligence. This holistic view reveals insights that single-source analysis misses, such as engineering talent quality, developer community engagement, and technical innovation depth.

ESG & Diversity Scoring. As corporate commitments to environmental and social goals intensify, filtering startups by ESG alignment has become a critical screening criterion.

With the usage of AI, startups aligned with the strategic priorities of an organization can be discovered faster, and even before their competitors do. This collaboration also ensures that the partnership aligns with corporate values and long-term sustainability goals.

Software-supported scouting on centralized platforms and connection to industry-specific databases speed up the process of finding startups of interest, giving more time for collaborative assessment and selection by members of your innovation community.

As intelligent discovery generates vast amounts of startup intelligence - often hundreds or thousands of potential partners across diverse technology domains and business models, without effective visualization and prioritization, this abundance of information can become overwhelming rather than actionable.

Visualize the findings on a startup radar

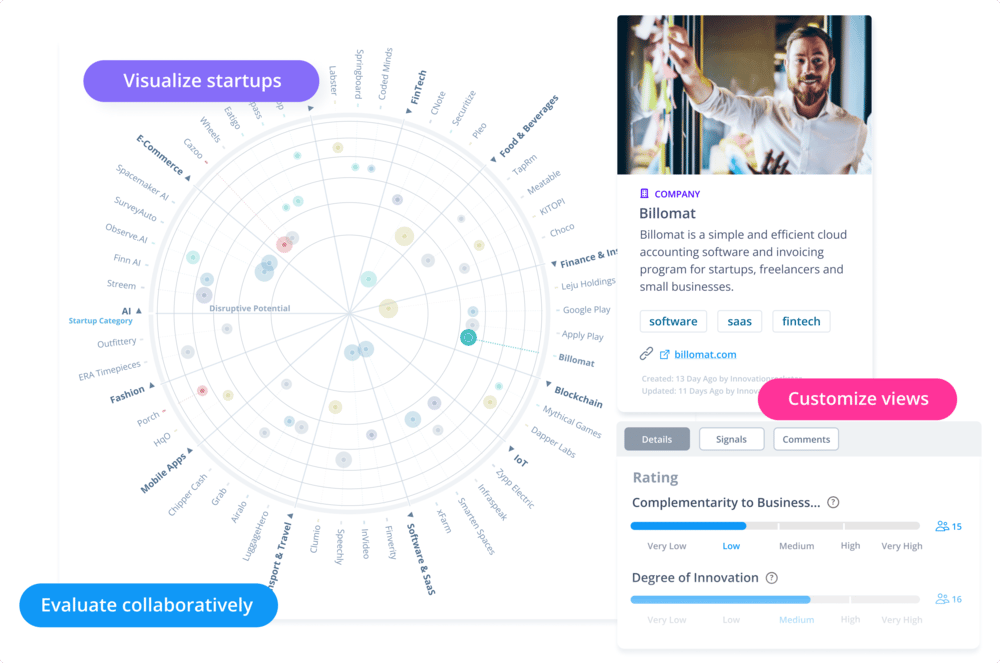

The findings from the scouting phase are evaluated and visualized through a Startup Radar (Exhibit 3). This visualization tool serves as a dynamic map of the startup ecosystem relevant to your organization. It also helps monitor the impact of startups on entire industries and track the adoption of innovative technology.

A well-designed Startup Radar enables innovation teams to:

-

Map competitive threats and opportunities by visualizing which startups are working in adjacent or overlapping spaces, and assess potential effects on market share

-

Identify white space where no startups are currently addressing potential market needs

-

Track ecosystem evolution over time, understanding how startup density and focus areas shift

-

Facilitate stakeholder communication by providing an intuitive, visual way to discuss external innovation landscape with executives and business units

-

Prioritize engagement by clustering startups according to strategic relevance, maturity, and potential impact

Exhibit 3: A startup radar at ITONICS

Leading organizations update their Startup Radars quarterly, treating them as living documents that inform strategic planning, investment decisions, and partnership priorities.

With a clear view of the startup landscape visualized on a Startup Radar, the next critical step is converting these insights into actual partnerships. Visibility alone doesn't create value as many organizations have sophisticated scouting capabilities, but struggle to transform discoveries into productive collaborations.

This is where the selection and engagement process becomes decisive, requiring frameworks that balance thorough evaluation with the speed startups demand.

How to find and select the right startup partner

Finding interesting startups is one thing, but choosing the right partners and engagement models is quite another. Many corporate innovation programs stumble at this critical juncture: scouting dozens or even hundreds of startups but struggling to convert those relationships into productive partnerships.

Therefore, the challenge goes beyond identifying capability: it’s matching that capability to specific business needs, determining the appropriate collaboration model, and securing internal buy-in for moving forward.

The right partnership can provide an unfair advantage by leveraging corporate assets and ensuring alignment with core businesses, which is essential for driving innovation and long-term success.

A comprehensive SRM approach transforms selection from an art into a science, providing frameworks for evaluation, cross-functional collaboration tools, and clear pathways from discovery to partnership.

Defining a comprehensive SRM approach

A growing proportion of corporations seek flexible partnerships with startups in which both sides take measured risks and share in the rewards. Before investing millions in an acquisition, it is essential to make smart startup recruitment decisions in the first place. Initial contacts with startups and “open door” policies have become standard practice.

A comprehensive SRM approach gives every business unit in the company - from strategy and business development to innovation, R&D, procurement, and finance - a unified framework to collaboratively evaluate and select startups for future recruitment and partnerships. Effective systems allow organizations to:

-

Filter large datasets with intelligent search to find the most relevant startups in specific technology or market areas

-

Make informed decisions about the right investment mix and match investments to innovation objectives

-

Centralize critical data such as contact information, funding status, geographic location, technology stack, and previous engagement history

-

Spot collaboration opportunities and potential partnership avenues across multiple business units

-

Enable cross-functional access so all involved teams can access startup data and intelligence without silos

Engaging with other partners beyond startups and planning for future partnerships is also essential to diversify collaboration, spread risk, and ensure long-term strategic growth.

The key is moving from ad-hoc, relationship-driven startup engagement to systematic, data-informed partnership decisions while maintaining the human element that makes collaborations successful. Change management plays a critical role in ensuring the successful implementation of SRM by helping organizations adapt, overcome internal resistance, and foster effective collaboration.

Having the infrastructure to discover and evaluate startups systematically creates the foundation for effective SRM. But discovery and evaluation answer only "who" and "how capable", they don't answer the equally critical question of "how should we engage?".

The chosen partnership strategy fundamentally shapes the value that can be extracted, the resources needed to commit, and the timeline for realizing returns. Getting this choice right requires understanding both the organization's needs and capabilities, and the startup's stage and expectations.

Choosing the right partnership strategy

After deciding who to work with, companies must determine the best strategy to engage and partner with selected startups. It’s also time to decide how to integrate those startups into the company’s innovation framework and methodology. Modern SRM recognizes seven distinct partnership pillars:

-

Build. Startups typically serve as inspirations for larger companies to build next-generation products and services on their own, become more agile, and leverage the latest technologies. The “build” approach means learning from startup innovations and incorporating those insights into internal development efforts, often by adopting similar methodologies, technologies, or business model elements. This can also involve building ventures collaboratively with startups and venture development firms, creating new business models from scratch as part of a hands-on innovation strategy.

-

Buy. When companies are missing specific expertise, they can acquire or make direct investments to bring in an external team of experts. This doesn’t typically mean acquiring an entire startup, but rather procuring certain services, technologies, or specialized skills offered by the startup.

-

Partner. More and more companies run structured startup initiatives and partnership programs. These models range from co-marketing agreements to joint customer pilots, providing startups with validation and market access while giving corporates insight into emerging technologies and business models. Startup accelerator programs are a key part of this pillar, offering early-stage startups mentorship, funding, and networking opportunities, often through corporate-backed initiatives.

-

Invest. Companies invest in promising startups working on the latest technologies potentially beneficial for their industry or their own growth. This can take the form of direct equity investments through corporate venture capital arms, participation in funding rounds alongside traditional VCs, or strategic investments tied to commercial partnerships. Corporate venturing is a strategic approach here, enabling large corporations to gain competitive advantages and financial returns by investing in external startups.

-

Co-develop. Companies co-develop products with startups, leveraging their expertise in a specific aspect of interest. In return, the startup gets access to market knowledge, mentoring, corporate networks, and often anchor customers for their solutions. Co-development arrangements often include shared intellectual property frameworks and joint go-to-market strategies. Building ventures together can also be a form of co-development, where both parties collaborate closely to launch new innovative businesses.

-

Ecosystem Play. Rather than one-to-one partnerships, corporations increasingly join or create innovation ecosystems, industry consortia, thematic accelerators, or innovation hubs. This approach provides access to multiple startups simultaneously while building broader innovation capabilities.

-

Talent Pipeline. Forward-thinking companies treat startup partnerships as recruitment channels, using them to identify and eventually hire exceptional talent through acqui-hires, creating alumni networks from failed partnerships, or building relationships with founders who may eventually want to join larger organizations.

The most sophisticated SRM programs orchestrate a portfolio approach through engaging different models based on strategic fit, maturity, and specific objectives. Adopting innovative approaches—such as sandboxing, new engagement models, and transforming incubators into venture units—can further maximize the success of corporate-startup collaborations.

Understanding partnership models provides the theoretical foundation for SRM, but success ultimately depends on execution. The partnership pillars offer strategic optionality, yet choosing the right model is only the beginning. The real challenge lies in implementing these approaches within the constraints of corporate reality: navigating internal politics, managing cross-functional stakeholders, and maintaining momentum when inevitable obstacles arise. This is where theory meets practice, and where many well-designed programs either prove value or reveal weaknesses.

Learning from real-world corporate-startup programs

Theory and frameworks are valuable, but the real test of any SRM approach comes in execution. This is where good intentions meet organizational reality, where startup speed collides with corporate process, and where carefully designed programs either deliver transformative value or become cautionary tales.

Alignment and support from the corporate side, especially the commitment and strategic oversight of top management, are essential to overcome these challenges and ensure successful collaboration.

The gap between companies that successfully leverage startup partnerships and those that struggle isn’t usually about resources or intent. It’s about understanding what actually works in practice. Adopting agile ways of working can help bridge the gap between startups and corporates, enabling faster decision-making, better collaboration, and more effective innovation.

What not to do in corporate-startup partnerships

Understanding common pitfalls in corporate-startup collaborations helps to build effective SRM capability, because even with good intentions and structured programs, they frequently stumble.

Out of our experience, the following pitfalls (Exhibit 4) occur most often. One key risk is failing to convert promising collaborations into a commercial deal, which can limit the long-term value of the partnership.

Exhibit 4: The most common pitfalls in corporate-startup partnerships

Understanding what to avoid is essential, but it's equally important to understand what actively drives success. While the pitfalls outlined above represent failure patterns to recognize and circumvent, the organizations that excel at SRM don't simply avoid mistakes, but proactively build capabilities and processes that make success repeatable.

The difference between companies that occasionally stumble into successful partnerships and those that consistently deliver value lies in these deliberate success factors.

Learning from success and failures

Behind every successful startup collaboration lies a repeatable system, and behind every failed one, a lesson worth capturing.

Therefore, learning from both successes and failures reveals factors that separate effective SRM programs from those that struggle. Analyzing success stories is crucial to understanding which approaches deliver the most value and to guide future collaborations.

Executive sponsorship with teeth. Successful programs have C-level sponsors who actively remove obstacles, provide air cover for faster decisions, and hold internal teams accountable for collaborating with external partners.

Dedicated resources. Effective programs have full-time teams focused on startup relationships, with clear mandates and protected budgets.

Startup-friendly processes. Creating parallel “fast track” processes for startups - streamlined contracts, expedited procurement, dedicated legal support - rather than forcing them through standard vendor management.

Portfolio mindset. Treating startup engagement as a portfolio of bets rather than requiring each partnership to be a guaranteed win. Accepting that some pilots will fail, some partnerships will end, and learning comes from the entire portfolio, not individual projects.

Two-way value creation. The best partnerships create genuine value for both sides. Corporations that focus only on what they can extract from startups build unsustainable relationships. Those that actively work to make their startup partners successful - through introductions, market access, technical support, and fair commercial terms - build lasting ecosystems.

Transparency and honesty. Being upfront about decision timelines, budget constraints, internal political challenges, and realistic chances of scale. Startups appreciate honesty much more than optimistic promises that never materialize.

Measuring what matters. Tracking meaningful metrics like time-to-partnership, pilot-to-production conversion rates, startup satisfaction scores, and actual business impact rather than vanity metrics like number of meetings held or startups “engaged.”

What is noticeable is that startup collaborations fail when they’re treated as a side project. Whereas the most effective programs are designed for speed, clarity, and mutual value. These truly measure what matters, remove internal friction, and treat startups like strategic partners. Fostering new ideas is essential for continuous improvement in SRM, ensuring that organizations remain innovative and agile.

To see how these elements work in practice, consider how leading corporations have structured their approach to startup collaboration, translating these principles into systematic processes that deliver measurable business outcomes.

Case study on partnering with external startups

Out in the market are several examples of successful startup-corporate partnerships, but many corporates fail to truly include startups. The following case shows how Unilever applies its approach to solve pressing challenges while creating measurable value for both the company and its startup partners. As a corporate partner, Unilever actively collaborates with external startups to co-create innovative products, leveraging these partnerships to explore new markets and drive growth.

Unilever’s startup collaboration is more than theory as it has already been tested across markets, challenges, and impact areas. By focusing on clear problem statements, mutual value creation, and structured partnership models, Unilever has turned external innovation into real business outcomes (Exhibit 5).

Exhibit 5: Unilever’s toolbox for successful startup-corporate partnership

More insights into the driving forces at Unilever’s program and insights into challenges and hurdles can be found here.

Ready to build a world-class startup relationship management capability?

The journey begins with an honest assessment of where an organization is today, a clear articulation of what it’s trying to achieve, and a commitment to doing the hard work of changing how an organization engages with external innovators. The startups are out there. The question is whether you’re ready to partner with them effectively.

Digital innovation tools and technologies have changed how corporations manage relationships with startups. SRM platforms provide specific functions for startup scouting, evaluation, and collaboration. These tools help organizations identify promising startups through systematic processes.

They enable teams to assess startup potential using structured criteria. The platforms facilitate collaboration by providing shared workspaces and communication channels. This systematic approach allows corporations to track emerging trends and make informed decisions about startup partnerships.

What leading SRM platforms enable

With ITONICS, you can bring radical changes in how corporates and startups collaborate, by creating a win-win situation, where each side is equally invested in the other’s success. Moreover, for many innovators, SRM is an imperative part of the corporate innovation toolkit.

By leveraging new technology in SRM, organizations can stay ahead in a rapidly changing market, enabling innovative projects and maintaining a competitive edge.

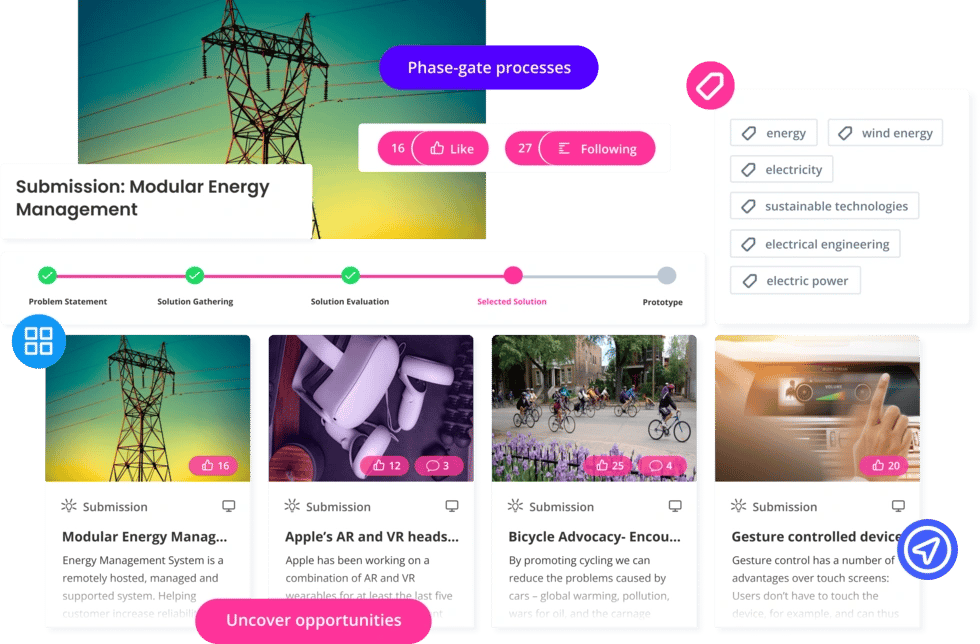

- All proposals in one place: Use ITONICS (Exhibit 6) to gather, track, and evaluate all submissions in one place, with custom workflows built for fast, focused decisions.

Exhibit 6: Phase-gate process for a submission

- Expand your network: Publish the most severe challenges on a public page and invite startups to pitch ideas (Exhibit 7). Use ITONICS to manage submissions and turn proposals into partnerships.

/Bosch-Fields-of-Interest.webp?width=897&height=667&name=Bosch-Fields-of-Interest.webp)

Exhibit 7: Showcasing open challenges to invite startups

- Manage partnerships with custom workflows: Startups breathe agility but suffocate in rigid processes. Use ITONICS to create flexible workflows that move at startup speed (Exhibit 8). So you can evaluate, engage, and grow partnerships systematically without slowing them down.

Exhibit 8: Customized workflows for idea management

To learn more about building a sustainable SRM practice and see how leading organizations are using integrated platforms to accelerate corporate-startup collaboration, we are here to help! Let’s build a sustainable SRM together!

FAQs on startup relationship management

How do I know whether my organization is ready for systematic SRM?

You are ready for SRM when startup engagement is no longer ad‑hoc, when your business units request external solutions, and when internal processes slow down collaboration more than capability does. If scouting feels reactive instead of strategic, it is time to formalize SRM.

What is the biggest internal blocker to successful startup collaboration?

Internal friction beats external risk every time. The biggest blocker is not startup immaturity but corporate inertia: slow procurement, unclear ownership, and evaluation frameworks built for vendors, not innovation partners. SRM succeeds when leadership removes those barriers intentionally.

How do I measure whether SRM is actually working?

Measure conversion, not activity. Time‑to‑pilot, pilot‑to‑scale ratio, internal adoption, and startup satisfaction are stronger signals than the volume of meetings or pitch decks. If SRM doesn’t speed decisions, reduce risk, and create measurable business value, it needs redesign.

What causes most dual-use partnerships to fail?

Most fail due to an evidence gap. Startups prove success in one market, but the validation doesn’t translate to the other. Venture clienting closes that gap by structuring pilots that generate evidence relevant to both markets.

How can ITONICS help organizations or startups applying a dual-use strategy?

ITONICS enables venture clienting through structured workflows, scouting tools, and evaluation dashboards. It helps organizations identify, assess, and scale technologies that deliver proven impact across both public and private markets.