Annual planning cycles cost organizations over ten percent of their investment before a single project fails. The culprit is not bad strategy. It is portfolio management designed for markets that no longer exist.

Without data-driven decision-making, decisions lag market reality by months. Resources stay locked into obsolete priorities. Leaders spend more time preparing reports than making decisive calls. PMI research shows that only 58 percent of organizations with an extensive portfolio realize intended business value from their projects, much of it lost to outdated portfolio processes.

This blog shows how modern strategic portfolio management empowers organizations by replacing static meetings with operating rhythms powered by continuous intelligence and real-time visibility. It gives you a clearer path to faster decisions, stronger strategic alignment, and business outcomes that do not slip away between intention and action.

What traditional strategic portfolio management processes look like

Traditional strategic portfolio management relies on annual strategic planning cycles, quarterly portfolio analysis, and static reporting. The decision-making process follows the calendar, not the data. Portfolio managers work with late, fragmented, and unreliable information rather than up-to-date information filtered through layers of project management reporting.

This model supports stable markets but fails when business leaders need instant insights and transparency for data-driven decision-making and the rebalancing of strategic initiatives to achieve desired business outcomes.

From annual strategic planning to quarterly portfolio analysis

Most organizations with an extensive portfolio still anchor strategic portfolio management in an annual planning cycle supported by quarterly portfolio analysis. It is a familiar rhythm, yet PMI research shows that only 58 percent of organizations realize the intended business value from their projects, largely because decisions lag behind changing conditions.

Best practice now centers on a strategic portfolio with continuously updated data that reflects real-time shifts in market opportunities and portfolio risks. Instead of waiting for steering committees, leaders rely on operating rhythms that surface immediate insights and keep strategic initiatives and change initiatives aligned with strategic goals and objectives. The result is faster decisions, improved operational efficiency, and stronger strategy execution.

Where traditional processes work and where they fail

Traditional strategic portfolio management processes work when strategic objectives are stable, markets are predictable, and performance can be guided by reliable data from historical patterns. Annual strategic planning aligned with business goals, fixed business cases, and diversification principles provide structure for established product lines with clear metrics and low uncertainty.

They fail when portfolio managers face volatile market shifts that challenge strategic direction, rising portfolio risks, or innovation projects that do not fit standard financial models. Static assumptions and calendar-driven governance slow strategy execution, limit informed decisions, and weaken strategic alignment. In fast-moving environments, leaders need accurate data and portfolio analysis that connects strategy to the most impactful initiatives.

Exhibit 1: Limits of traditional portfolio management approaches

Recognition of these failure modes is common. What separates high performers is what they do next.

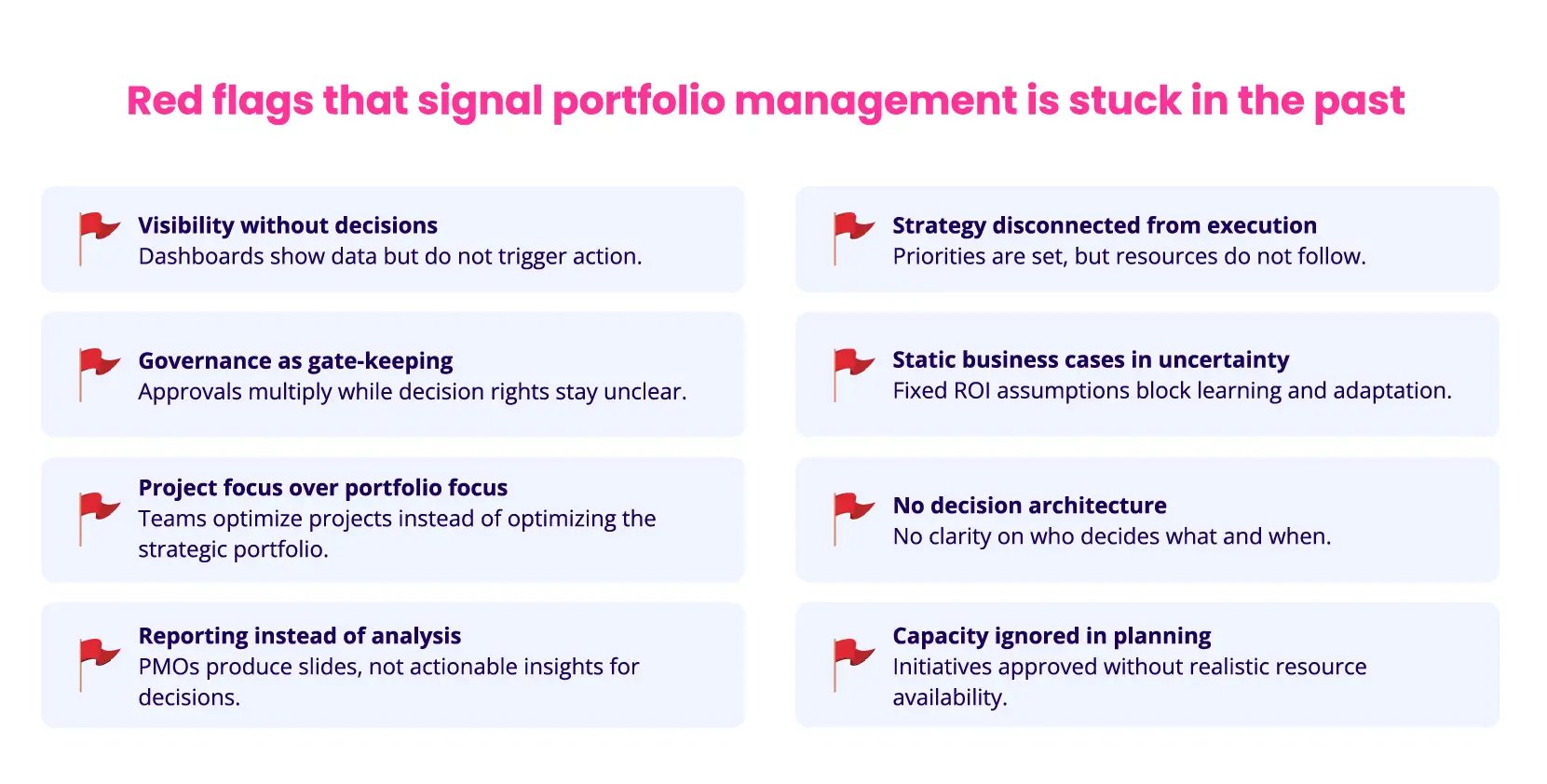

8 signs your portfolio management is stuck in the past

Many organizations still rely on portfolio management practices designed for slower, more predictable markets. These strategic portfolio management habits create delays, blind spots, and misaligned priorities. Here are eight signs your current approach is holding back strategy execution, business success, and business outcomes.

1. They build visibility instead of decision-making

Many organizations invest heavily in executive dashboards that improve visibility but do not improve decisions. Data appears impressive, yet no one defines "if X happens, we do Y." Without triggers, thresholds, or actionable insights, strategic portfolio management becomes passive monitoring rather than actively managing toward strategic objectives.

2. They confuse governance with gate-keeping

Portfolio governance gets mistaken for control. Leaders add approval layers, sign-offs, and review meetings that slow strategy execution and reduce operational efficiency. Real governance clarifies decision rights, evidence standards, and timing. Ask who can kill a project mid-flight. Most executives answer, "It depends." That ambiguity is the problem.

3. They manage projects instead of portfolios

Teams debate individual project priorities without assessing the broader strategic portfolio or how investments align with organizational strategy. This leads to fragmented decisions and risk concentration. Effective strategic portfolio management asks a different question: given our organization's strategic goals, business goals, capacity, and business strategy, what is the optimal portfolio configuration that drives the most strategic outcomes?

4. They treat portfolio management as reporting

In many organizations, the strategic portfolio management office spends weeks of manual effort producing slide decks and updating spreadsheets. It is not unheard of for global manufacturing firms with an extensive portfolio to spend excessive manual effort and hours each month on status reporting, which could translate to an equivalent of several full-time strategic analysts they could not afford to hire. Leaders receive information too late to act. Reporting replaces analysis, and insight gives way to formatting.

5. They separate strategy from execution

A strategic portfolio plan with objectives defined in isolation creates execution decisions that follow different business processes and constraints. The result is misaligned priorities, diluted results, and inconsistent resource allocation. Without a strategic portfolio that connects strategy to delivery, organizations fail to execute their overall business strategy or adapt investment decisions as market conditions shift.

6. They rely on fixed business cases in uncertainty

Traditional business cases assume predictable outcomes and rely on stable financial data rather than reliable data, which does not reflect innovation funnels or high-uncertainty domains. Leaders request five-year ROI models when strategic learning is the real value. This locks capital budgets into outdated assumptions and prevents decision makers from identifying trends or adjusting investment decisions as conditions evolve.

7. They operate without a decision architecture

Few organizations can clearly articulate who can kill a project, reallocate resources across strategic programs, establish clear processes for allocating resources, or shift funding within the capital portfolio. The decision-making process relies on negotiation instead of design. A modern strategic portfolio requires decision architecture that defines roles, evidence, pacing, and scope. Without it, data-driven decision-making becomes impossible, decision makers struggle to act, and the organization loses its competitive edge.

8. They ignore capacity when shaping the portfolio

Strategic planning approves initiatives, finance allocates budgets, and operations later discover that limited resources make delivery impossible. Portfolio managers often learn too late that the organization has committed to 150 percent of available capacity. A connected portfolio links the organization's strategic goals and capital plans from the start so teams can effectively execute and achieve desired outcomes.

These symptoms compound over time. Organizations spend more effort managing the portfolio process than improving the portfolio itself. Building a responsive system requires four disciplines working together.

Exhibit 2: Eight indicators that your portfolio management approach is outdated.

The four pillars on which modern portfolio operations run

Traditional strategic portfolio management relies on fixed plans, periodic reviews, and reporting cycles that cannot keep pace with shifting strategic objectives. Building a strong integrated portfolio through a strategic portfolio management process means creating a system that continuously aligns investments with strategy to drive business success, reallocates resources based on evidence, and turns decisions into action with minimal friction.

Modern strategic portfolio management operates as a continuous system built on four reinforcing pillars:

-

-

Portfolio Analysis

-

Portfolio Governance

-

Portfolio Optimization, and

-

Portfolio Performance.

-

Together, these strategic portfolio management pillars create an operating model that enables faster, more informed decisions. This is an operating system that makes strategy executable every week, not once a year.

Analysis is the foundation

Portfolio analysis: continuous intelligence, not snapshots

Portfolio analysis turns project data into actionable insights. Track where capital flows across portfolio assets, which bets deliver, and where risks accumulate. As one of four pillars in an integrated portfolio approach to strategic portfolio management, analysis plays a vital role in linking strategic priorities to execution. Without it, governance stalls, and prioritization relies on instinct rather than evidence.

Most organizations still review portfolios quarterly or twice yearly. That worked when market cycles moved slowly. Today, competitive windows compress from years to quarters. Between review cycles, regulations shift, competitors launch, and technologies mature faster than forecasted. Strategic misalignment compounds. Capital gets trapped in obsolete initiatives.

Continuous monitoring empowers organizations to change the data-driven decision-making game. You catch inflection points while options remain open.

Using data-driven analysis to surface actionable insights

Real-time dashboards built on reliable data replace periodic reports. Track strategic alignment across active projects. Monitor resource concentration by domain. Set automated alerts for critical thresholds: flag when one initiative consumes 30 percent of budget, or when exploratory work drops below 15 percent of investment.

Through data-driven decision-making, leading teams reallocate capital mid-quarter based on live signals. Laggards wait for scheduled reviews and miss the window.

How portfolio analytics uncover hidden patterns and portfolio risks

Analytics expose what slide decks hide. You spot resource conflicts before they derail delivery. You see concentration risk building in a single technology domain as portfolio assets become imbalanced. You discover that incremental projects consume 80 percent of capacity while competitors place transformational bets.

Organizations that rely on snapshots learn about failures months too late. High performers detect misalignment early and redirect resources before waste compounds.

Diagnostic questions for strategic goals and portfolio fit

Three questions force operational clarity:

-

-

What percentage of portfolio investment targets revenue streams we don't have today? If the answer is below 15 percent, you are optimizing the present at the expense of the future.

-

How many projects in our top 20 would our closest competitor never fund? If the answer is zero, you are following the industry instead of leading it.

-

Can you name the three projects you would kill tomorrow if forced to free 20 percent capacity? If you cannot answer immediately, your portfolio lacks clear strategic hierarchy.

-

Honest answers require current data. Continuous intelligence lets you act on weak signals early and shifts portfolio management from an accounting exercise to strategic instrument.

Remember the governance-as-gatekeeping trap? Decision rights solve it by clarifying who owns each call.

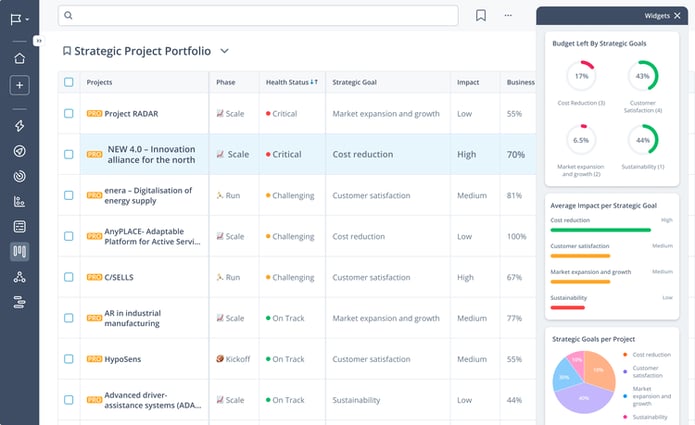

Exhibit 3: Real-time dashboards in the ITONICS platform used for portfolio analysis

Portfolio governance: decision rights, not gate-keeping

Integrated portfolio governance defines who decides what, when, and based on which criteria. Done well, it empowers organizations by accelerating innovation and operational efficiency through clarifying authority and accountability. Done badly, it becomes bureaucracy that slows execution while creating the illusion of control.

Most governance frameworks fail because they confuse oversight with obstruction. Stage gates multiply. Approval layers stack. Decision timelines stretch from weeks to months. Teams spend more time preparing for reviews than building solutions. The process protects against failure but also prevents speed.

Effective governance does the opposite. It aligns strategic intent with execution by pushing decision rights closer to the work.

Governance that connects strategy and execution

Clear governance establishes a decision-making process that answers three questions before projects start:

-

-

Who owns go/kill decisions at each stage?

-

What evidence triggers those decisions?

-

How quickly can capital move from failing bets to emerging opportunities?

-

When these answers are vague, strategy and execution disconnect. Projects drift. Resources stay locked in low-potential initiatives because no one has clear authority to stop them.

Decision rights that streamline processes

Leading organizations define decision rights by investment tier. Small bets get approved at business unit level with monthly review cycles. Mid-tier initiatives require cross-functional sign-off with quarterly checkpoints. Transformational bets sit with executive committees but use fast-track provisions for strategic pivots.

This tiering eliminates bottlenecks and improves operational efficiency. Teams move at the speed their work demands rather than waiting for universal approval cadences.

How top performers structure portfolio governance

High performers separate strategic oversight from operational execution. Executive committees set portfolio boundaries and resource envelopes. They define risk appetite and balance targets. Then they delegate within those constraints.

They also build escalation paths for exceptions. When market conditions shift dramatically, teams can bypass standard cycles. The governance structure serves the strategy rather than the calendar.

Clear decision rights enable the next pillar: dynamic rebalancing that responds to market reality.

/Videos/HiFi-Animation-Portfolio-Monitor-Portfolio-Health.png?width=778&height=467&name=HiFi-Animation-Portfolio-Monitor-Portfolio-Health.png)

Exhibit 4: Decision rights, permissions, and thresholds in the ITONICS platform for portfolio governance

Portfolio optimization: dynamic rebalancing, not annual allocation

Portfolio optimization focuses on allocating resources and finite capital across competing initiatives to maximize strategic return. It balances investment capital, execution capacity, and acceptable risk within defined constraints. Most organizations treat this as an annual planning exercise. They lock their strategic portfolio plan allocations in January and revisit them twelve months later.

That approach assumes stable conditions for the strategic portfolio. Markets do not cooperate. Technologies evolve faster than budget cycles. Customer priorities shift mid-year. Competitors move. By the time annual planning arrives, your portfolio reflects last year's strategic direction, not today's reality.

Dynamic rebalancing changes the model. You adjust allocations continuously as conditions change.

Moving from static ranking to dynamic optimization

Static ranking lists projects by score and funds from the top down until budget runs out. It is simple but rigid. Dynamic optimization treats the portfolio as a living system. It tracks project performance against milestones. It monitors capacity constraints across teams. It reassigns resources when initiatives stall or accelerate faster than planned.

Dynamic rebalancing requires infrastructure that most organizations lack. Purpose-built platforms like ITONICS connect project data, resource systems, and governance workflows in real time, eliminating the manual effort and manual reconciliation that make quarterly rebalancing impractical.

Balancing investment, capacity, and portfolio risks

Three constraints compete for attention. Investment capital limits how many portfolio assets and other assets you can fund. Execution capacity determines what teams can actually deliver. Risk tolerance defines how much uncertainty you will accept across the portfolio.

Optimizing one dimension while ignoring others creates problems. Fully allocated budgets mean nothing if teams lack capacity to execute. Aggressive risk profiles fail when concentrated in single domains.

Tradeoffs leaders must confront for strategy execution

Every rebalancing decision forces tradeoffs. Do you starve ten incremental projects to fund one transformational bet? Do you pull resources from a struggling initiative or give it one more quarter? Do you maintain portfolio balance targets or concentrate capital where momentum builds?

When rebalancing quarterly, apply the 70-20-10 test: 70 percent of investment in core business optimization, 20 percent in adjacent expansion, 10 percent in transformational bets. If your numbers drift to 85-10-5, you are optimizing for short-term performance at the expense of strategic positioning and sustainable growth.

High performers make these calls with reliable data, current insights, and clear criteria. They accept that optimization means disappointing some stakeholders to serve the strategy. They rebalance quarterly or monthly rather than annually, treating resource allocation as a strategic lever instead of a static strategic portfolio plan.

Optimization feeds the final pillar: performance measurement that drives learning.

Exhibit 5: Applying Prism AI in the ITONICS platform to align and optimize strategic portfolios

Exhibit 5: Applying Prism AI in the ITONICS platform to align and optimize strategic portfolios

Portfolio performance: learning loops, not compliance reporting

Strategic portfolio management performance measurement enables leaders to measure progress and track whether innovation investments deliver strategic outcomes. Most companies measure performance through quarterly reports that document what happened. High performers use performance data to shape what happens next.

The difference is purpose. Compliance reporting satisfies governance requirements. Learning loops drive a better decision-making process and better decisions.

Metrics that reveal if strategic planning is working

Standard metrics track project health. Strategic metrics measure progress and reveal portfolio effectiveness:

-

-

Percentage of budget aligned to priority themes (target: 70%+)

-

Cycle time from concept to launch by initiative type

-

Return on innovation investment by category

-

Portfolio balance against stated strategic targets

-

You can hit every milestone while funding the wrong portfolio. Ask: Does our investment distribution match our strategy deck and business goals? Are we learning faster than our competitors?

How monitoring accelerates strategy execution

When leaders continuously monitor performance, they create feedback loops that static reporting cannot. Teams see performance gaps in real time, maintain operational efficiency, and adjust tactics mid-flight. Leaders spot patterns across portfolio assets and reallocate capital toward what works.

This velocity matters. Competitors who learn faster make better bets. They kill failures early and double down on winners while the window stays open.

Reviews (not reporting cycles) that drive action

Reporting cycles produce documents. Reviews produce decisions. Structure reviews to drive action:

-

Pre-read data circulated 48 hours ahead, so meetings focus on implications

-

Specific decision points: continue, pivot, pause, or kill

-

Clear ownership assigned with checkpoints before the next review

High performers run monthly reviews with tight agendas focused on operational efficiency. Reserve quarterly sessions for strategic recalibration. Ask: Are we making binding decisions or just discussing status?

Performance measurement becomes a strategic instrument instead of administrative overhead.

Exhibit 6: Using Prism AI in the ITONICS platform to actively monitor and manage portfolio performance

How to build a modern strategic portfolio management process

The four pillars work only when connected in an integrated portfolio. Isolated analysis, governance, optimization, and performance tracking create silos. Integration empowers organizations by turning them into an operating system that aligns strategy to execution in real time and delivers results between quarterly reviews.

Start your strategic portfolio management transformation by establishing continuous data flows that feed all four pillars simultaneously. Connect project performance metrics to governance triggers so decision rights activate automatically when thresholds are breached. Link optimization algorithms to capacity systems so rebalancing reflects actual capacity constraints.

Purpose-built software makes this integration possible at scale. Manual processes requiring excessive manual effort cannot maintain the speed or accuracy required to support data-driven decision-making in real-time across an extensive portfolio of complex initiatives.

Modern strategic portfolio management is not a methodology to adopt. It is an operating system to build. Start with continuous intelligence. Add governance clarity. Layer in dynamic rebalancing. Close the loop with learning-driven performance reviews.

The four pillars work only when connected. Once integrated, they turn strategic portfolio management from a compliance exercise into a strategic instrument that executes while others report.

FAQs on the Modern Strategic Portfolio Management Process

What's the difference between traditional and modern strategic portfolio management?

Traditional portfolio management relies on annual planning cycles and quarterly reviews that lag market reality by months. Teams spend weeks producing static reports while decisions wait for scheduled governance meetings.

Modern portfolio management operates as a continuous system. Real-time data feeds analysis, governance, optimization, and performance measurement simultaneously. Decision rights are predefined, resources are rebalanced monthly or quarterly, and learning loops replace compliance reporting.

The shift isn't about faster meetings. It's about eliminating the gap between market signals and strategic action. Organizations using continuous intelligence catch inflection points while options remain open, not months after opportunity windows close.

How do you implement portfolio governance without creating bottlenecks?

Scan relevant data and identify weak Signals in real-time. Backed by NLP technology and named entity recognition, teams have instant access to millions of verified sources.

What metrics actually reveal portfolio effectiveness?

Standard project health metrics miss strategic performance. Track percentage of budget aligned to priority themes (target 70%+), cycle time from concept to launch by initiative type, and portfolio balance against stated strategic targets.

Apply the 70-20-10 test quarterly: 70% core business optimization, 20% adjacent expansion, 10% transformational bets. If you drift to 85-10-5, you're optimizing short-term performance at the expense of strategic positioning.

Ask diagnostic questions: What percentage targets revenue streams you don't have today? How many top-20 projects would competitors never fund? Which three would you kill tomorrow to free 20% capacity? Honest answers require current data.

How often should portfolios be rebalanced?

Annually is too slow. Markets shift, technologies evolve, and customer priorities change faster than 12-month cycles. By the time annual planning arrives, your portfolio reflects last year's strategy, not today's reality.

High performers rebalance quarterly or monthly, treating resource allocation as a strategic lever. Dynamic optimization tracks project performance against milestones, monitors capacity constraints, and reassigns resources when initiatives stall or accelerate.

Rebalancing this frequently requires infrastructure that most organizations lack. Purpose-built platforms eliminate the manual reconciliation that makes continuous optimization impractical at scale.

Can portfolio management work without specialized software?

Manual processes cannot maintain the speed or accuracy required for real-time decision-making across complex portfolios. Spreadsheets and slide decks worked when markets moved slowly, and reviews happened quarterly.

Continuous portfolio management needs real-time data flows connecting project metrics, governance triggers, optimization algorithms, and capacity systems. When thresholds breach, decision rights must activate automatically. When rebalancing occurs, it must reflect actual execution constraints.

Purpose-built platforms like ITONICS make this integration possible at scale. The four pillars (analysis, governance, optimization, performance) work only when connected into an operating system, not managed as isolated activities.