Your R&D portfolio is bleeding cash into projects that will never launch. Your governance board just approved another "strategic" initiative that contradicts last quarter's priorities. Your best project managers are updating Excel sheets instead of developing products.

Most organizations treat R&D governance as a necessary evil, as a bureaucratic overhead that slows down the "real work" of invention. They're half right: bad governance absolutely suffocates the development of new solutions. But here's what they miss: the absence of governance creates inefficiencies disguised as autonomy.

The uncomfortable truth? Without clear governance structures, your resource allocation becomes a political battleground where resources flow to whoever argues loudest, strategic alignment becomes accidental, and portfolio risks accumulate invisibly until they explode.

More governance also leads to more clarity. Clarity about what is a strategic priority. Clarity about who decides what. Clarity about when to reallocate resources. Organizations that master governance structures create a competitive advantage. Systematic and rule-based decision-making is faster, smarter, and more strategically aligned than anything committees can produce.

This article breaks down what effective R&D governance looks like: structural approaches grounded in control objectives for R&D (CORD). You'll learn how to design governance that accelerates decision-making rather than bureaucratizes it and how to implement it without triggering organizational adoption barriers.

A deeper look at governance

Strong governance ensures reporting is credible and provides insights on projects, company priorities, and investment success when needed. It also includes metrics about data quality, risk status, and patent applications where applicable. Clearly state the total cost per initiative and whether investments are aligned with strategic or regulatory expectations.

Transparency is crucial and builds trust, especially in regulated industries or when reporting on monetary value generated is company-critical.

The three pillars of governance: Structures, mechanisms, and relationships

Effective R&D governance rests on three foundational pillars that must function as an integrated system. When these pillars operate in isolation or receive unbalanced attention, governance frameworks collapse under their own weight. Understanding these pillars reveals why so many governance initiatives fail despite good intentions and substantial investment.

- Structures define formal authority and accountability. Without clear governance structures, strategic alignment becomes impossible, and basic task completion depends on individual initiative rather than systematic discipline. At worst, different business units work on identical problems in opposite directions, producing resource waste, missed deadlines, and organizational frustration. Governance structures answer critical questions: "Who does what? Who is accountable, responsible, informed, and consulted? Who reports to whom, and when?"

- Mechanisms turn assignments into action. Structure without mechanism produces paralysis as decision makers lack the information, criteria, and processes needed to make informed decisions. Governance mechanisms define how resources are allocated, what criteria determine funding and prioritization, how results are presented to key stakeholders, and which metrics trigger intervention, escalation, or reprioritization. These mechanisms operationalize governance policies by specifying when risk escalates from project concern to leadership decision.

- Relationships comprise the formal and informal networks that make governance work in practice. When relationships are weak, functions protect narrow interests, information travels slowly through organizational silos, and cross-functional collaboration becomes performative rather than productive. The result: siloed decision-making, hidden trade-offs, and governance activities that check boxes without improving outcomes. Effective governance structures create forums where genuine collaboration happens, knowledge sharing occurs naturally, and relevant stakeholders align around strategic priorities before conflicts escalate.

Most governance failures trace to pillar imbalance rather than conceptual misunderstanding. Organizations invest heavily in structures but neglect the mechanisms needed for those structures to function effectively. Others implement elaborate mechanisms like stage-gate processes and key performance indicators without clarifying decision-making authority or building the relationships required for cross-functional collaboration.

The three principles of governance: Strategic alignment, clarity, and integration

Understanding the three pillars reveals what governance is made of, but architectural components alone don't guarantee effective implementation. The difference between governance that accelerates decisions and governance that paralyzes organizations lies in how those components operate.

Three principles guide effective governance design, transforming structures, mechanisms, and relationships from administrative overhead into competitive advantage.

- Strategic alignemnt over local optimization. Portfolio-level strategic value must take precedence over project-level success or business unit performance. Effective governance establishes structures that elevate portfolio decisions above local interests, mechanisms that measure strategic value alongside execution metrics, and relationships that reward contributions to organizational strategy rather than functional excellence. When strategic alignment governs resource allocation, even painful decisions - killing successful projects, reallocating high-performing teams, entering unfamiliar markets - become possible because the criteria transcend politics.

- Clarity enables speed. Clarity operates across three dimensions: who holds decision rights at each organizational level, what criteria determine go/no-go choices and resource allocation, and how issues escalate when they cross authority boundaries. When governance specifies these elements precisely, portfolio boards decide market entry, program managers decide scope trades within budgets, project managers decide technical approaches - decisions happen at the speed execution demands.

- Integration over isolation. Governance fails when structures, mechanisms, and relationships must reinforce each other as an integrated system. Effective governance recognizes that who acts, mechanisms enable that action through processes and information, and relationships determine whether people actually follow the governance framework or circumvent it. Integration demands simultaneous attention to all three pillars during design and operation.

These three principles operate interdependently: Strategic alignment demands clarity about priorities and integration across all three pillars, clarity enables alignment by making authority explicit, and integration is impossible without clarity and strategic purpose.

Organizations possess governance boards, stage-gates, and metrics - yet governance fails because strategic alignment gets sacrificed to politics, clarity gets abandoned for flexibility that becomes ambiguity, or integration gets replaced by selective implementation. Therefore, the pillars define what to build, and the principles define whether what you build actually governs.

The operational center of governance

Authority without accountability breeds negligence, as well as accountability without authority breeds frustration. R&D governance fails when these fundamental elements misalign, creating organizational friction that drains resources and delays critical decisions. Three organizational elements determine whether governance structures enable or impede portfolio decisions:

- the portfolio management office that coordinates across business units,

- the governance bodies that hold decision authority, and

- the accountability mechanisms that ensure consequences follow choices.

The portfolio management office (PMO) serves as the operational center of portfolio governance, coordinating across business units, tracking portfolio performance, and ensuring relevant stakeholders possess the information needed for informed decisions. The portfolio manager's role sits within the PMO as a strategic orchestrator who identifies patterns invisible to individual project managers: patterns in portfolio risks, resource conflicts, strategic misalignment, and emerging opportunities that become visible only at the portfolio level.

Composition shapes governance focus. PMO composition determines what the office sees, values, and prioritizes. The most effective portfolio management offices blend strategic thinking, financial literacy, and operational experience.

This combination enables the PMO to translate organizational strategy into clear objectives for program managers, convert technical progress reports into strategic insights for decision makers, and identify market trends that require portfolio adjustments before competitors respond:

- Strategic thinkers ensure governance activities maintain focus on the organization's strategic objectives.

Financial expertise enables credible resource allocation recommendations and portfolio performance analysis.- Operational experience builds credibility with project managers and functional managers who might otherwise dismiss PMO guidance as disconnected from execution reality.

Mandate defines authority boundaries. The mandate question determines whether the portfolio management office advises or decides, and ambiguity here creates constant friction.

Clear mandates specify precisely what the PMO controls directly and what it escalates to governance boards or senior decision makers. Direct control typically includes portfolio performance reporting to relevant stakeholders, tracking key performance indicators against intended benefits, maintaining the portfolio governance management plan, facilitating knowledge sharing across teams, and coordinating governance activities like stage-gate reviews.

These functions enable the PMO to maintain continuous strategic alignment through systematic monitoring and coordination.

Control objectives for R&D (CORD): The governance framework for aligned research and development

The Control Objectives for R&D (CORD) framework applies proven governance principles to research and development, defining the structures, mechanisms, and relationships that transform fragmented R&D efforts into strategically aligned portfolios.

CORD addresses a fundamental problem: most governance failures stem not from lack of frameworks but from imbalanced implementation. Organizations build elaborate organizational structures - job profiles, decision matrices, governance boards - but skip the mechanisms that make decisions stick, such as prioritization rules or escalation protocols. Others create detailed processes without clarifying who holds decision-making authority.

Thus, CORD forces holistic thinking by organizing governance around interdependent components that must work together to deliver portfolio performance.

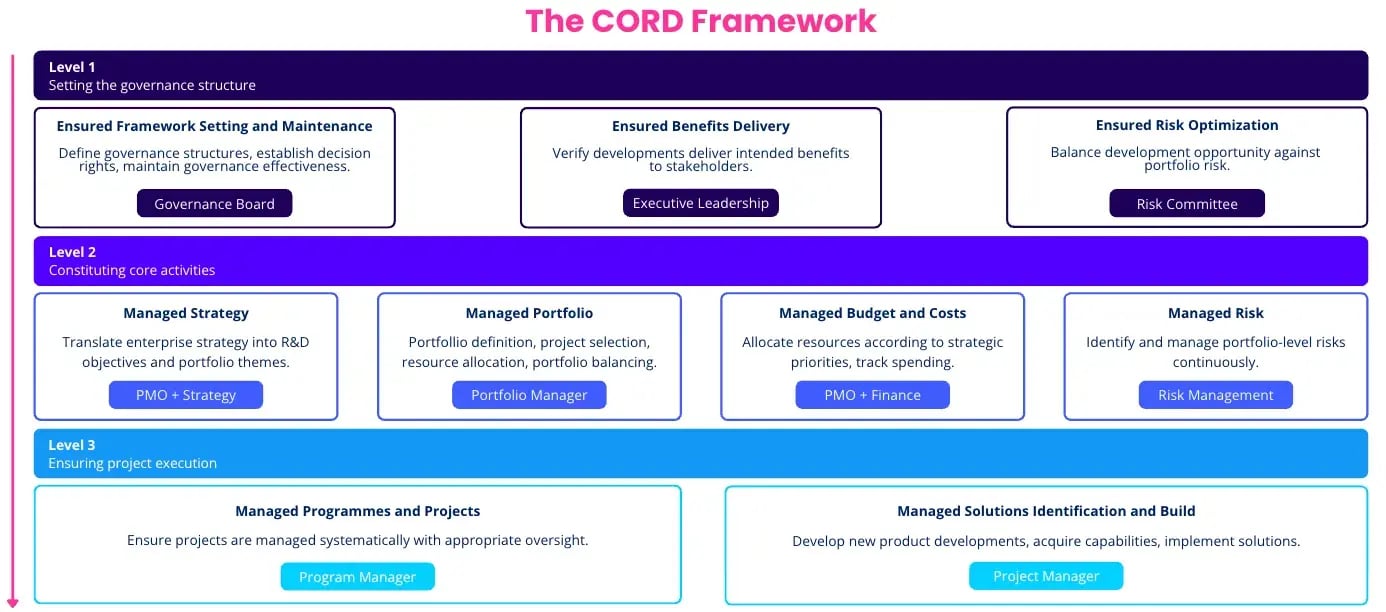

Level 1: Setting the governance structure

This domain (Exhibit 1) operates at the highest strategic level, where key stakeholders define the organization's strategic objectives, establish governance structures, and maintain governance effectiveness. The governance board ensures that R&D efforts serve organizational goals rather than becoming ends unto themselves.

Exhibit 1: Setting governance structure to evaluate, direct, and monitor R&D objectives

At this level, three strategic tasks need to be executed:

- To ensure that the R&D governance framework is set and maintained, the governance board needs to define clear governance structures, establish decision rights, and maintain governance effectiveness.

When projects stall, it's often due to unclear responsibilities. The RACI chart enables strict role definition across complex projects, helping organizations assign ownership and avoid confusion.

When everyone knows who's Responsible, Accountable, Consulted, and Informed, work flows smoother, and results come faster as stakeholders are aligned and responsibilities are assigned.

Download the RACI Matrix Template to define roles, eliminate confusion, and keep your projects on track.

2. To ensure the delivery of the R&D governance framework, the executive leadership needs to verify that developments deliver intended benefits to stakeholders.

3. To ensure that risk is optimized, the risk committee balances the opportunities of each new development against portfolio risks.Therefore, governance bodies like the governance board, executive leadership, and the risk committee are required.

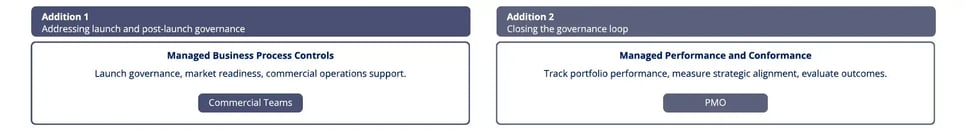

Level 2: Constituting core activities

This domain (Exhibit 2) translates organizational strategy into R&D objectives and portfolio themes, defines portfolio composition through project selection, allocates resources according to strategic priorities, and manages portfolio-level risks continuously. The portfolio manager operates primarily in this domain, maintaining strategic alignment while enabling execution. Key governance processes like portfolio balancing, resource allocation, and risk management planning occur here.

Exhibit 2: Constituting the core of portfolio management office activities to align, plan, and organize R&D objectives

For the second level, four strategic tasks are required:

- To ensure that the enterprise strategy is managed successfully, the PMO in collaboration with strategy managers, needs to translate the overall strategy into R&D objectives and R&D portfolio themes.

- To ensure that the portfolio is managed successfully, the portfolio manager needs to define the portfolio, select relevant projects, allocate resources, and balance the portfolio.

- To ensure that budget and costs are aligned, the PMO and Finance department need to allocate resources according to strategic priorities to track spending.

- To ensure that the risk is managed appropriately, the risk management department needs to identify and mange toe portfolio-level risks continuously.

Thus, for the successful execution of the level, several governance bodies are involved: PMO in collaboration with strategy managers, the portfolio manager, PMO together with Finance, and the risk manager.

Level 3: Ensuring project execution

This domain (Exhibit 3) ensures individual projects are managed systematically with appropriate oversight. Program managers and project managers operate in this domain, executing research activities within the guardrails established by higher-level governance. While execution receives less direct governance attention than strategy or portfolio management, this domain ensures that new products are actually developed, capabilities are acquired, and solutions are implemented according to plan.

Exhibit 3: Ensuring project execution governance to build, acquire, and implement R&D objectives

For the last level, two main tasks are necessary:

- To ensure that programmes and R&D projects are managed respectively, program managers need to ensure that they manage projects with appropriate oversight.

- To ensure that solutions are identified and built, project managers need to develop new product developments, acquire the respective capabilities, and implement solutions.

Therefore, only two governance bodies are required: the program and project manager.

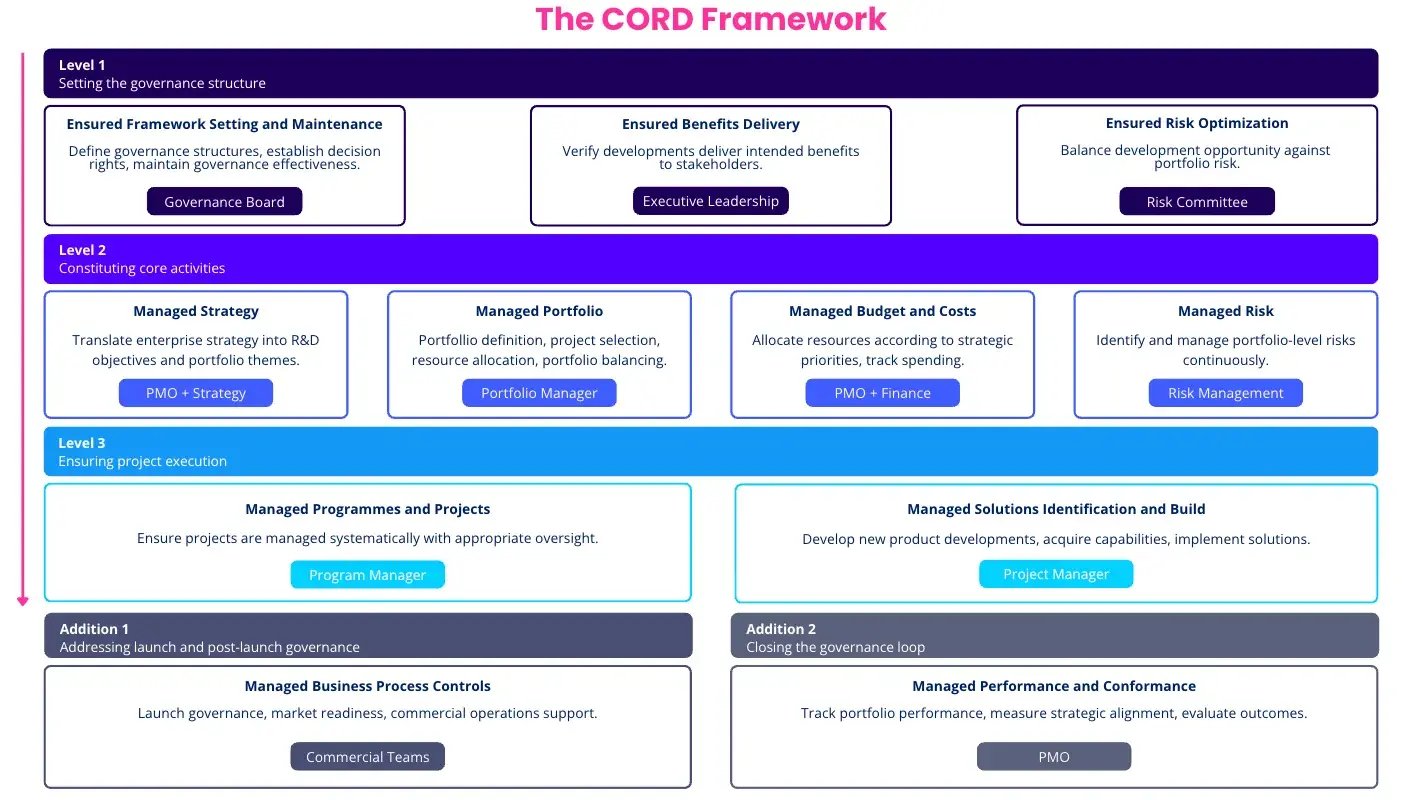

The CORD framework: From levels to operational outcomes

CORD translates the three foundational levels into operational tasks (Exhibit 4) that structure portfolio governance from strategy to execution. These components map directly to R&D challenges, providing specific guidance on how to implement governance structures, establish governance mechanisms, and build the relationships that enable strategic alignment.

Exhibit 4: The three levels of the CORD framework

In addition to the three levels, organizations need to consider two further steps to complete R&D governance successfully (Exhibit 5).

Exhibit 5: Two additional capabilities of the R&D framework

- Addressing launch and post-launch governance. This domain brings cross-functional collaboration into sharp focus, as launching new products requires coordination between multiple departments beyond R&D. Governance activities here ensure that technically successful projects translate into market success rather than failing during commercialization.

Are you funding the right projects? If not, connect strategy, market data, and team insights to stop guessing and start knowing.

/Still%20images/Roadmap%20Mockups%202025/portfolio-link-projects-teams-and-milestones-2025.webp?width=267&height=167&name=portfolio-link-projects-teams-and-milestones-2025.webp)

Separate value drivers from the 30 to 40 % draining resources while scoring each initiative against an organization's strategic priorities: new revenue, customer retention, and cost savings.

Find what's really driving value to reallocate capacity to higher-return opportunities.

2. Closing the governance loop. This domain enables continuous improvement by capturing lessons from completed initiatives and feeding insights back into governance processes, making the organization progressively better at portfolio governance over time.

Together, they create a comprehensive governance framework that balances control with agility while ensuring continuous strategic alignment across the entire portfolio.

Contextual factors driving the CORD framework design

Contextual variables shape the CORD framework (Exhibit 6). Thus, generic best practices don’t exist in these scenarios as effective governance reflects the specific reality.

Exhibit 6: The CORD framework for R&D governance

Company strategy is the primary design factor.

- Are you defending existing products through incremental renewals? Governance should prioritize risk management and ensure new features don't compromise quality.

- Pursuing new markets through disruptive ideas? Governance needs to enable fast failure and resource reallocation without executive approval for every pivot.

Company goals cascade into portfolio governance management plans.

- If growth targets require entering adjacent markets, governance structures must enable project selection based on strategic fit and not just ROI.

- If margin pressure demands efficiency, governance activities should eliminate redundant research activities and consolidate efforts.

Risk profile determines how tightly you govern.

- Regulated industries like pharmaceuticals need stringent governance to manage compliance risks.

- Software companies innovating in unregulated spaces can afford looser structures that prioritize speed over certainty.

IT implementation methods matter more than R&D leaders admit.

- If your new product depends on digital platforms, your governance framework must integrate with IT governance. Misalignment here creates disasters: product teams commit to features that IT can't support, or IT builds platforms no one asked for.

Innovation strategy influences how you evaluate progress.

- Early adopters of emerging technologies need governance that tolerates high failure rates and learns fast.

- Late adopters need governance that ensures thorough validation before commitment.

Company size and organizational complexity determine governance scale.

- A startup needs minimal governance structures - maybe a weekly leadership sync where key decisions get made in minutes.

- An enterprise spanning multiple business units needs formal governance boards, clear escalation paths, and mechanisms that prevent local optimization from undermining organizational goals.

Sourcing models shape governance when R&D involves external partners.

- Open innovation, joint ventures, and acquisitions each require different governance mechanisms. You can't govern external relationships the same way you govern internal resources.

The mistake many organizations make: copying governance frameworks from industry leaders without adapting for design factors. What works for a global pharmaceutical company governing regulated drug development won't work for a mid-size software firm pursuing platform plays.

Building future-ready portfolio governance with ITONICS

Effective R&D governance requires both solid frameworks and enabling technology. The CORD framework provides the structural foundation: defining governance components, establishing accountability through the goals cascade, and ensuring strategic alignment through systematic processes.

/Still%20images/Portfolio%20Mockups%202025/portfolio-hero-2025.webp?width=2102&height=1190&name=portfolio-hero-2025.webp)

Exhibit 7: Driving R&D leadership with portfolios and roadmaps

But implementing CORD at scale demands digital infrastructure that makes governance mechanisms work without drowning in administrative overhead. ITONICS (Exhibit 7) bridges this gap by providing integrated portfolio management capabilities that operationalize CORD principles:

-

unified portfolio visibility across business units,

-

structured workflows that enforce decision-making processes,

-

transparent resource allocation aligned with strategic priorities, and

-

real-time portfolio performance reporting that enables continuous strategic alignment.

ITONICS creates the transparency and traceability essential for effective governance while enabling the cross-functional collaboration that makes governance frameworks deliver actual value.

When CORD provides the blueprint, and ITONICS provides the enabling infrastructure, organizations can build governance structures that accelerate innovation rather than bureaucratize it - to transform governance from organizational overhead into competitive advantage.

FAQs on R&D governance structures

What is R&D governance, and how is it different from R&D management?

R&D governance defines who decides, with what authority, and under which constraints. R&D management executes work within those boundaries. When organizations conflate the two, they create activity without impact, where projects move forward but strategic alignment erodes.

How does R&D governance differ from portfolio management?

Portfolio management optimizes resources within an approved scope. R&D governance defines the decision-making authority that approves that scope in the first place. A portfolio manager can reprioritize projects, but a governance framework determines who approves budgets, assigns veto rights across business units, and triggers portfolio-level intervention.

What role does the portfolio management office play in effective R&D governance?

The portfolio management office is the operational backbone of portfolio governance. It translates strategy into portfolio objectives, turns project data into decision-ready insights, and coordinates governance activities across business units. Its value lies in enabling continuous, informed decision making, not in enforcing bureaucracy.

Why do many R&D governance frameworks fail in practice?

Most failures stem from unclear decision rights and imbalanced governance pillars. Organizations add committees and processes without defining authority, escalation triggers, or accountability. The result is slow decision making, political negotiation, and zombie projects that consume resources without delivering strategic value.