Most business leaders believe their business problems come down to data quality. Too little information. A messy tool landscape. Uninformed strategic planning. They're wrong: the problem is the timing of decision-making.

By the time strategic decisions get made, the information driving them is six to nine weeks old. The business world has already shifted. A competitor entered a new market. The business strategy changed. A project has burned another month of budget due to insufficient risk management.

Data-driven decision-making consistently outperforms instinct-led approaches — tech giants have proven this repeatedly. Yet most strategic decision processes still run on lagging data. AI closes that gap with continuous intelligence, turning portfolio management into a real-time strategic decision-making process.

.webp?width=1668&height=924&name=The%20Cost%20Breakdown%20of%20Delayed%20Visibility%20in%2050M%20Portfolios%20(and%20the%208%20SPM%20AI%20Use%20Cases).webp)

Exhibit 1: The cost breakdown of delayed visibility in $50M portfolios (and the 8 AI SPM use cases)

This article covers eight AI use cases that improve how organizations make strategic decisions across alignment, execution, and organizational learning. Using AI for strategic decision-making is becoming the decisive factor for future success and competitive edge.

Common challenges in strategic decision-making today

Strategic decision-making is a critical skill for business leaders, yet many organizations face persistent challenges that hinder effective choices aligned with their business vision and key objectives. Understanding them is essential for overcoming common challenges and driving future success.

Strategic drift goes unnoticed. Over time, approved initiatives can lose alignment with the company's mission and long-term goals. Without continuous monitoring, business leaders only realize this misalignment months later, often after valuable resources have been spent.

Portfolio balance degrades. Short-term priorities often expand at the expense of strategic bets and innovation. This imbalance remains hidden until periodic reviews reveal that critical projects supporting long-term goals are starved of resources.

Dependency conflicts cascade. Delays in one project can cause ripple effects across multiple initiatives. These cascading dependencies often become apparent too late, locking timelines and increasing potential risks to the overall business strategy.

Kill decisions come too late. Organizations frequently continue funding underperforming projects until they consume 60-80% of the budget before agreeing to stop. Late kill decisions waste resources and slow down the ability to pivot toward more promising opportunities.

Institutional knowledge remains buried. Valuable lessons from past projects and strategic decisions are often siloed within business units. Without effective knowledge sharing, teams repeat mistakes, reducing efficiency and undermining competitive edge.

By addressing these issues, organizations can enhance team collaboration, improve risk management, and better align immediate needs with their overall mission and long-term success.

8 cases of how artificial intelligence redefines strategic management

The core shift AI enables is from periodic reporting to continuous intelligence. Instead of preparing for the next review meeting, strategic decisions get signals in real time — when misalignment emerges, when product line dependencies conflict, when budgets drift from long-term goals, when decision-making failure patterns repeat.

Effective leadership in modern strategic decision-making requires a broad range of real-time inputs across external and internal factors. Strategic leaders need informed decisions at the moment they matter, not six weeks after the fact.

Across $50M+ portfolios, eight AI use cases deliver up to 36% efficiency gains.

Strategic alignment — making strategic decisions about the right things

Use case 1: Dynamic strategic relevance scoring

The challenge

Strategic priorities evolve faster than quarterly review cycles. A project approved to pursue new customer segments loses relevance when the acquisition strategy changes. An initiative targeting specific market trends becomes misaligned when broader company goals shift.

The strategic planning process rarely accounts for how fast conditions move. Leaders discover misalignment during formal reviews — after burning budget on work that no longer serves the company's mission or overall objectives.

How AI enables continuous strategic alignment

AI continuously scores every initiative against current strategic pillars, competitor moves, regulatory changes, and trends. When strategy shifts from market expansion to operational excellence, the system flags immediately which projects no longer align.

Exhibit 2: ITONICS AI assistant flags off-strategy projects

Effective strategic decision-making requires trustworthy information at the right time. AI tracks external and internal factors simultaneously, recalculating strategic fit in real time.

For a $50M R&D portfolio across 60 projects, 10-15% of initiatives lose strategic relevance each year. Without continuous monitoring, that drift goes undetected for six to nine months. With dynamic relevance scoring, drift is detected within weeks.

Economic impact: 40-50% reduction in misalignment waste. That's $2.4M-$3M recovered annually.

Key takeaway: Strategic drift isn't caused by bad strategic decisions. It's caused by good decisions that became outdated and weren't caught in time.

Use case 2: Continuous portfolio balance optimization

The challenge for business success

Your portfolio seemed balanced at the year's start, but breakthrough projects hit roadblocks while incremental ones surged. By mid-year, 70% of resources focus on safe, short-term work, starving long-term goals and strategic bets. The strategic planning process set clear intent, but real-world execution drifted. Quarterly reviews reveal decision-making issues too late to adjust without disruption.

AI-driven resource allocation for long-term goals

Research shows firms with balanced portfolios (e.g., 70% core, 20% adjacent, 10% transformational) outperform peers by 10-20% in price-to-earnings ratios. Companies that dynamically manage resource distribution are 2.4 times more likely to achieve superior long-term goals.

AI continuously monitors portfolio balance across innovation horizons, risk profiles, time-to-market, and resource allocation. Effective strategic decision-making happens within weeks, enabling timely strategic decisions before problems escalate.

Economic impact: 10-15% improvement in portfolio ROI. That's $5M-$7.5M in additional value annually.

Key takeaway: Portfolio imbalance is invisible until it's expensive. Continuous monitoring converts a quarterly fire drill into a weekly management routine.

Exhibit 3: ITONICS alert informing about an increase in the trend "Autonomous Networks"

Use case 3: Intelligent white space and opportunity detection

When competitors capture opportunities you should have owned

Your competitor just announced a product serving customer segments you already have, using technology you understand. You had the strategic choice to build it. You didn't make that business decision.

By the time opportunities become obvious, the window for first-mover advantage has narrowed. Organizations that remain flexible in scanning market demand consistently identify opportunities earlier than those relying on ad-hoc decision-making.

Making strategic decisions before the market does

AI continuously scans technology trends, patent filings, competitor announcements, regulatory changes, and internal capabilities. It identifies where multiple industry trends converge to create new opportunity spaces, then maps them against your strategic priorities, long-term objectives, and available resources.

The decision-making output is specific: "Trend X plus your strength in Y plus market gap Z equals a potential $40M opportunity with an 18-month head start." Companies pursuing adjacent opportunities in new markets systematically grow 1.5 times faster. Without systematic scanning, organizations miss 60-70% of adjacent opportunities, finding the rest six to twelve months too late.

Economic impact: $8M-$15M in new opportunity value annually.

Key takeaway: Missing white spaces is a scanning failure, not a strategic decision-making failure. AI converts reactive market watching into proactive opportunity positioning.

Execution excellence — doing things right

Use case 4: Predictive early warning systems

Why the current decision-making process fails

Traditional decision-making operates on lagging indicators. Status dashboards show what has already happened. By the time a project turns red, the problem has been compounding for weeks. Seven out of ten initiatives experience scope creep. 50% fail to meet planned timelines.

The gap between planning and execution costs organizations $2 trillion annually — not from picking the wrong projects, but from executing the right ones poorly.

The decision-making process breaks down when reliable information is missing until it's too late to act on it.

AI-powered signals that reach strategic decisions earlier

AI monitors hundreds of initiatives simultaneously — communication patterns, velocity trends, dependency chains, resource conflicts. It synthesizes weak signals into composite risk alerts well before long-term goals are at risk.

"Project velocity down 15% across three consecutive sprints, plus key resource over-allocated across four initiatives, plus vendor response time increased 40% equals 85% probability of missing a milestone in six weeks."

Predictive systems identify cascading risks four to six weeks earlier, enabling proactive resource distribution and preventing the domino effect that typically extends problems across 15-20% of the portfolio.

Economic impact: 30-40% reduction in execution waste. That's $1.8M-$2.4M in annual savings.

Key takeaway: Status reports tell you where you've been. Predictive early warning tells you where you're heading — with time to change course.

By leveraging machine learning and continuous data analysis, business leaders can monitor progress in real time, making informed decisions that align with the company's mission and strategy.

Use case 5: Intelligent dependency and ripple effect analysis

Hidden risks in the strategic decision-making process

Teams map dependencies manually during planning — documented in spreadsheets, buried in project charters, or living in people's heads. By the time a critical dependency conflict surfaces, multiple teams have committed resources, and timelines are locked. A two-week slip in one initiative cascades into six months of delays across eight others.

Exhibit 4: Roadmap with projects and milestones showing schedule conflicts

Making strategic decisions about execution without visibility into the full dependency network means working with incomplete information.

Complete information for strategic decisions

AI continuously maintains a complete dependency map — technical dependencies, resource dependencies, knowledge dependencies, and market timing constraints. It uncovers hidden connections that human planning misses and quantifies the potential outcomes of each conflict before it becomes a crisis.

"Initiative A delayed 3 weeks plus shared architect committed to B and C plus D's market launch window closes in Q3 equals 4 initiatives at risk, $8M revenue impact, intervention needed within 10 days."

For a $50M portfolio, unmanaged dependencies create tripling effects worth $9.5M or more annually. AI catches conflicts four to six weeks earlier — when alternatives still exist.

Economic impact: 50-60% reduction in dependency-driven delays. That's $4M-$5M in annual savings.

Key takeaway: Dependency management is a continuous monitoring task, not a planning task. Manual maps are outdated the moment reality diverges from the plan.

Use case 6: Dynamic budget optimization

The gap between budgets and strategic decisions

Budget variance reports answer "Are we on plan?" Making strategic decisions about resource allocation requires answering a different question: Should we change the plan?

For a $50M portfolio where 20-30% of projects are underperforming, continuing to fund based on outdated projections costs $3M-$5M in unrealized value over two quarters. Collaborative decision-making between finance and portfolio leaders breaks down when neither team has access to real-time ROI trajectories.

AI-driven financial intelligence for business leaders

AI transforms budget data from historical reporting into predictive financial intelligence. It tells business leaders and key stakeholders which budget variances represent value creation versus value destruction.

Project A is 30% over budget, but customer adoption is three times projections — actual ROI is 240%, continue funding. Project B is on budget but has missed milestones for three months — projected ROI dropped from 180% to 40%, and funding is at risk. Project C is underspending by $800K because a vendor delayed — execution risk, not efficiency.

When organizations need to cut $5M from the portfolio, AI shows which trade-offs hurt least strategically. Organizations rebalancing toward higher-value initiatives achieve three times higher revenue.

Economic impact: 8-12% improvement in portfolio value delivery. That's $4M-$6M in additional value.

Key takeaway: Dynamic budget optimization replaces plan-versus-actual reporting with actual-versus-potential analysis. The strategic implications are entirely different.

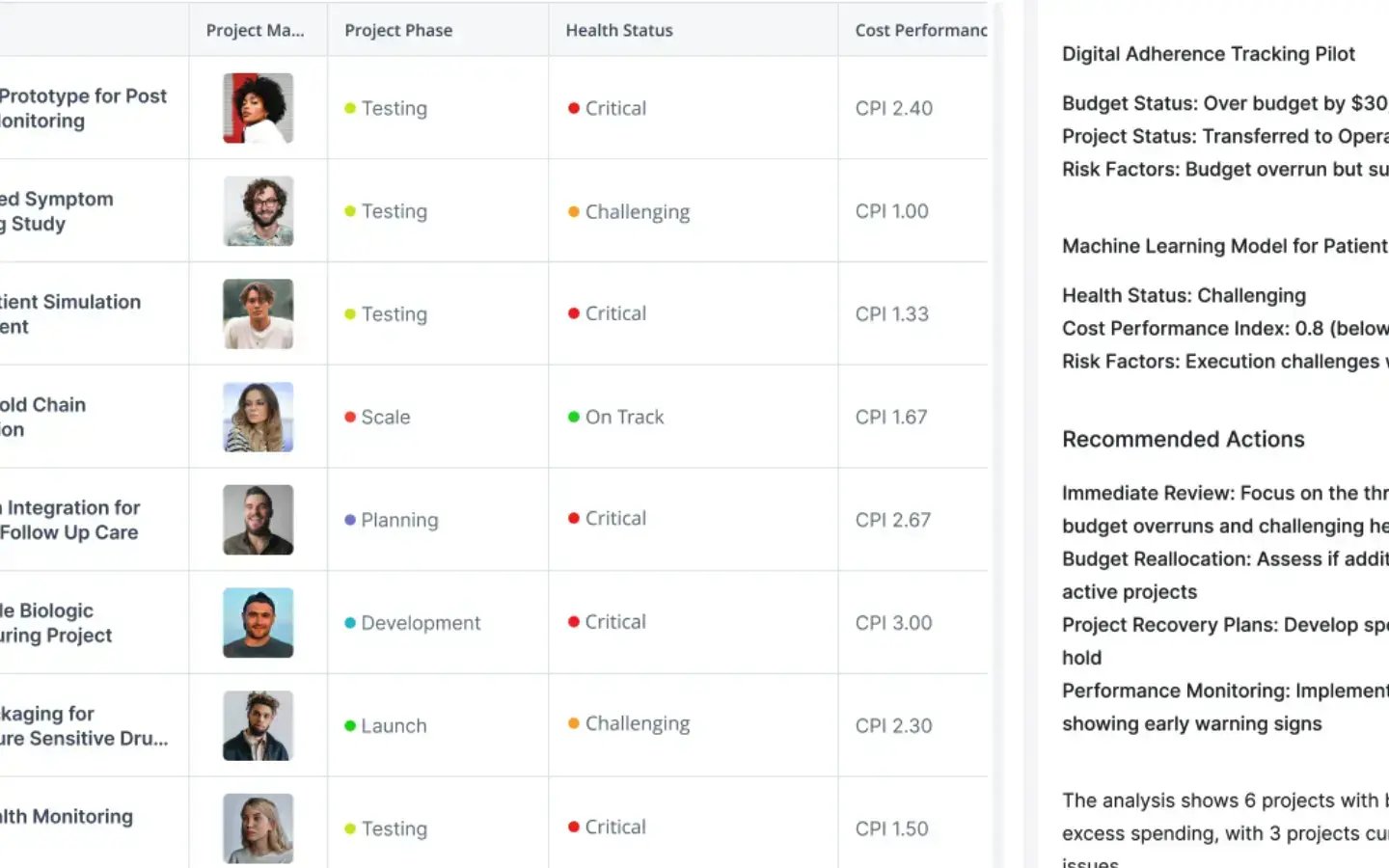

Exhibit 5: ITONICS AI assistant flagging project risks

Adaptive intelligence — learning fast enough

Use case 7: Objective kill and pivot signal detection

The hardest business decisions

Every organization has projects that should stop. Kill decisions depend on subjective judgment where teams defend their work, sponsors protect investments, and business leaders operate without objective data. Failed projects consume 60-80% of the budget before organizations agree to stop — by then, $2M-$4M more has been burned. Strategic thinking suffers when political pressure substitutes for evidence.

Evidence-based strategic decisions on difficult calls

AI provides objective kill and pivot signals based on performance patterns across your portfolio history. When a project shows trouble, the system surfaces historical context and quantifies probable outcomes — stop, pivot, or continue — with probability-weighted value estimates.

"Kill now, recover $1.2M. Pivot to reduced scope, 70% probability of $3M value with $900K investment. Continue, 25% probability of $8M value, 75% probability of $5M+ losses."

This changes the conversation from "are we giving up too soon?" to "here's what the data says about making strategic decisions in this situation." Critical thinking replaces political pressure as the basis for action.

AI-powered signals enable decisions three to four months earlier — stopping underperforming projects at 30-40% budget consumption instead of 70-80%.

Economic impact: $2.5M-$4M recovered annually for a $50M portfolio with three to five kill or pivot candidates per year.

Key takeaway: Late kill decisions are failures of information, not courage. Objective signals inform judgment rather than replace it.

Use case 8: Cross-portfolio pattern recognition and learning

The institutional knowledge problem

80% of organizations spend at least half their time on rework — repeating work that should have been done the first time correctly. Your organization has run 163 projects over three years. That's 163 projects worth of strategic decisions, vendor assessments, and lessons learned — buried in post-mortems and the memories of people who have since moved roles.

By the time someone thinks to ask, "Has anyone done this before?" the vendor is already selected, and the mistake is already in motion. The evaluation process for new vendors or approaches starts from zero every time.

Exhibit 6: Innovation dashboard showing relevant innovation KPIs

Turning history into active intelligence

AI surfaces portfolio history at the moment it's relevant — making strategic leaders more effective without requiring anyone to go looking.

When a procurement team receives a promising vendor proposal, AI surfaces immediately: "This vendor was engaged in 2023. Delivery missed three milestones. Support averaged 8 days versus the promised 24 hours. Project delayed 5 months. $340K in additional integration work. Would not recommend for mission-critical work."

Without pattern recognition, organizations pay twice to learn the same lesson. A consistent step-by-step process for capturing and applying portfolio history reduces repeated failures by 50-70%.

Economic impact: $3M-$5M in avoided costs annually.

Key takeaway: Institutional knowledge isn't lost. It's inaccessible at the moment it's needed. AI makes it active rather than archived.

The real business success math

Across eight use cases, individual estimates sum to $24M-$36M annually for a $50M portfolio. The realistic figure is lower because the use cases overlap and compound. Faster strategic decision-making prevents resource conflicts. Objective kill signals free resources before market windows close. Pattern learning avoids budget overruns that trigger emergency reallocation.

The honest estimate: AI-powered strategic portfolio management delivers $12M-$18M in annual value for a $50M portfolio — a 24-36% improvement in portfolio efficiency.

Key elements of effective AI implementation in decision-making frameworks

Start where the pain is highest

Don't implement all eight capabilities at once. Match your starting point to where your organization struggles most. The decision-making frameworks below align each starting point with immediate business impact.

-

Is strategic misalignment the main concern? Start with dynamic strategic relevance scoring. Impact shows up immediately in portfolio reviews.

-

Are resource constraints choking execution? Start with dependency mapping. Visible relief arrives within four to six weeks.

-

Burning budget on failing projects for too long? Start with objective kill and pivot signal detection. The first prevents late-stage failure and pays for the entire AI investment.

-

Repeating expensive mistakes across business units? Start with cross-portfolio pattern recognition. It delivers immediate ROI and builds the foundation for all other capabilities.

The 90-day process for the first results

Weeks 1-4: Connect your existing portfolio data. Let the system surface misalignment between current initiatives and overall mission and company goals. This is the foundation for all strategic business decisions going forward.

Weeks 5-8: Run a horizon scan. Identify market trends and industry trends affecting your portfolio. Use AI-generated insights to validate or challenge your current investment thesis and long-term goals.

Weeks 9-12: Integrate AI insights into governance processes. Replace manual status reporting with predictive risk signals. Course-correct before good money follows bad.

Scenario planning and SWOT analysis meet continuous intelligence

Traditional SWOT analysis captures internal factors and external factors at a single point in time. Scenario planning builds out potential futures based on assumptions that may already be outdated.

AI-powered strategic management applies both continuously — monitoring market position, competitive advantage, potential risks, and emerging opportunities in real time. Strategic leaders stop waiting for the next planning cycle to understand where the portfolio stands against business goals and long-term success.

Gain decision-ready visibility from strategy to execution with ITONICS

ITONICS provides the operating system for strategic portfolio management and strategic decision-making.

Exhibit 7: One single source of truth for all strategic management activities

Real-time strategic alignment runs automatically. Dashboards show projects drifting below 70% strategic fit within weeks, enabling business leaders and decision makers to identify misalignment 4-6 weeks before visible failure. This proactive insight supports informed decisions that balance immediate needs with long-term goals, enhancing overall strategy making and corporate success.

Automate opportunity discovery: Manually tracking and evaluating new opportunities consumes valuable time and resources. ITONICS automates opportunity discovery using artificial intelligence and machine learning, continuously scanning political, economic, social, technological, environmental, and legal factors. This ensures your company operates ahead of trends, regulatory changes, and emerging risks, providing valuable insights for innovation strategies and strategic planning.

Decision memory captures hypotheses, outcomes, and lessons from every major strategic decision. With each decision, your organization improves its strategic thinking and risk management by leveraging past financial performance data and potential benefits. This team effort strengthens collaborative decision-making and drives success.

Traditional portfolio management tells you what happened last quarter. ITONICS tells you what's about to go wrong next month — while you can still act on strategic initiatives and market opportunities, optimizing resource allocation and enhancing your competitive advantage.

FAQs on AI in strategic management

How does AI improve strategic decision-making in portfolio management?

AI replaces periodic reporting with continuous intelligence. It scores initiatives against current strategy in real time, flags dependency conflicts before they cascade, and surfaces budget trajectories as they emerge — giving decision makers weeks of lead time instead of reacting to problems after quarterly reviews.

What is the realistic ROI of AI in strategic portfolio management?

For a $50M portfolio, AI-powered strategic portfolio management realistically delivers $12M-$18M in annual value — a 24-36% improvement in portfolio efficiency.

This accounts for overlapping use cases and recognizes that alignment, execution, and learning capabilities compound rather than operate independently.

Where should organizations start when implementing AI for portfolio decisions?

Start where the pain is highest. Strategic misalignment: begin with dynamic relevance scoring. Execution delays: start with dependency mapping.

Late kill decisions: start with objective kill and pivot signal detection. Repeated mistakes across units: start with cross-portfolio pattern recognition. Each delivers measurable impact within 90 days.

How is AI-powered strategic portfolio management different from traditional project management tools?

Traditional project management tools track individual initiative status — they tell you what happened.

AI-powered strategic portfolio management tracks the entire portfolio against strategy, market conditions, and historical patterns simultaneously.

It tells you what is about to happen and what strategic decisions are needed before problems compound.

/Still%20images/Element%20Mockups%202025/foresight-stay-in-the-loop-2025.webp?width=2160&height=1350&name=foresight-stay-in-the-loop-2025.webp)

/Still%20images/Roadmap%20Mockups%202025/portfolio-visualize-critical-paths-2025.webp?width=2160&height=1350&name=portfolio-visualize-critical-paths-2025.webp)

/Still%20images/Reports%20Mockups%202025/portfolio-optimize-portfolio-returns-2025.webp?width=2160&height=1350&name=portfolio-optimize-portfolio-returns-2025.webp)

/Still%20images/Explorer%20Mockups%202025/capabilities-reports-change-your-view.webp?width=2160&height=1350&name=capabilities-reports-change-your-view.webp)