Challenge: Identifying Gaps and Opportunities in the Innovation Portfolio

The times when a solid business model worked for decades are also over in the banking sector. The new customer expectations of financial service providers in the digital age pose new challenges for the innovation work in banking. Customers long for banking integrated into their life situation, comprehensible, comparable, and personalized products, sufficient security, and immediate service availability.

The existence of new digital competitors (Fintechs) in recent years is also threatening and changing all areas of the value chain in the banking business. So how does a major bank manage to become an innovative mastermind?

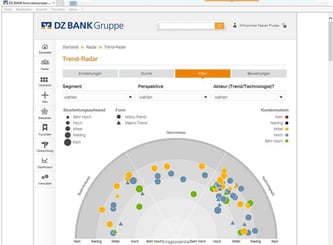

Since April 2016, the DZ BANK Group is successfully using a software platform, the so-called "DZ BANK Innovation Radar", to link trend and technology management (external perspective) with its own innovation activities (internal perspective) and thus gain an overview of the company-wide innovation portfolio (see also: Innovation Blog DZ BANK).

Innovation at DZ BANK

- Decentralized organizational structure leads to inefficiencies & duplicate work

- Innovations not initiated & controlled centrally but by various divisions & Group companies

- Numerous innovation activities at all levels of the DZ BANK Group

- Looking for cooperation instead of confrontation with new fintechs

Objectives

- Transparency: making innovations accessible across different departments and fostering collaborative assessment

- Interconnection: identifying relevant trends and technologies and covering them with the own innovation activities

Solution: All Trends, Technologies, and Innovation Activities on one Innovation Platform

- Scout and link: Collaborative scouting and linking of trends, technologies, and innovation activities on one innovation radar platform

- Evaluation of trends:

Strategic evaluation of trends with regard to the own business area on the basis of ten criteria (e.g. customer benefit, earnings potential, suitability for the mass market)  Interconnection and evaluation of activities:

Interconnection and evaluation of activities:

Visualization of all trends, technologies, and innovation activities according to evaluation criteria in the innovation radar and identification of strategic relevance- Observing the market environment:

Research of (fintech) startups and transparency about cooperations in additional fintech radar

Result: Monitoring of Innovation Activities and Fintechs Based on Collaborative Innovation Radar

- Visualization of all innovation activities of the various banks and departments, their contacts, and relevant trends and technologies are mapped on a central innovation platform

- Over 120 employees from various business divisions and Group companies of the DZ BANK active on platform

- Identification of gaps in the innovation portfolio by linking all internal and external information

- Integration of a fintech module for cross-departmental monitoring of the market environment

- Creation of a transparent and company-wide overview of all fintech cooperations

| 120 employees active on the platform |

100 and more displayed innovation activities |

165 and more scouted fintechs |

DZ BANK AG Deutsche Zentral-Genossenschaftsbank, headquartered in Frankfurt am Main, is the central institution for around 900 Volksbanken Raiffeisenbanken and has over 30,279 employees. As a central bank, its mission is to support the business of the many independent local cooperative banks and to strengthen their competitive position. The range of services extends from traditional and innovative products through structuring and issuing to trading and distribution in the equity and bond markets.

Additional Sources:

- https://innovationsblog.dzbank.de/2016/11/01/trendsitter-statt-trendsetter-der-dz-bank-innovationsradar-teil-1/

- https://innovationsblog.dzbank.de/2017/03/13/sehen-und-gesehen-werden-der-dz-bank-innovationsradar-teil-2/

- https://innovationsblog.dzbank.de/2017/06/12/tummelei-im-fintech-teich-der-dz-bank-innovationsradar-teil-3/

.jpg??&width=379&height=288&name=Header-Communicate-Key-Findings-2%20(1).jpg)