Most companies treat environmental scanning like a newsletter. They skim it, file it, and never act on it.

But when scanning shifts from trend collection to early identification of opportunities and risks, portfolio decisions become defensible and future-oriented. Organizations that miss this don't fail overnight; they drift out of relevance as competitors spot shifts faster.

Strategic planning cycles now move more slowly than the environment changes. Regulatory shifts reshape market access. Technologies mature faster than expected. New entrants redefine categories. By the time these signals reach quarterly reviews, the window to respond has closed.

/environmental-scanning-process.webp?width=966&height=544&name=environmental-scanning-process.webp)

Exhibit 1: The environmental scanning process

Effective environmental scanning converts signals into portfolio adjustments continuously, not episodically. It answers: Which projects to fund? Which capabilities to build? Which markets to enter or exit?

This article explains how to design an environmental scanning process that informs these decisions, the five principles that separate insight from noise, and the tools required to run scanning at scale.

What environmental scanning actually is

Environmental scanning is the discipline of observing your external environment to identify opportunities and risks. By the intensity, environment scanning can be scanning, scouting, or monitoring. As it typically spans across different innovation horizons, environment scanning is also called horizon scanning.

Real environmental scanning tracks emerging technologies, regulatory changes, market shifts, and competitive moves continuously. It combines diverse external sources from industry publications to wild-card scenarios in order to inform business decisions. What strategic bet to fund? Where to allocate resources? What are future customer needs?

Environmental scanning converts external signals into insights for the strategic planning process, innovation strategies, and internal pipelines.

When environment scanning benefits strategic planning and risk management

Environmental scanning matters most when external conditions change faster than your strategic planning process can adapt.

Economic growth patterns shift. Regulatory landscapes evolve. Technological disruptions accelerate. Without strategic foresight, organizations react to changes that competitors already exploited.

The alternative to systematic scanning is information overload. Teams drown in signals without prioritization. Or they ignore external conditions entirely until crisis forces reaction.

A proactive approach means scanning continuously, not annually. It means identifying risks before they materialize and opportunities before markets validate them.

Strategic planning without environmental scanning assumes tomorrow resembles today. That assumption destroys organizational well-being faster than any external threat.

Organizations structure scanning in two ways:

-

distributed responsibility, where individuals monitor their domains, or

-

centralized teams providing corporate foresight as a service to business units.

Both work. Neither works without a systematic process.

5 principles of an effective environmental scanning process

Your team receives 50 signals this week alone.

China announces AI export restrictions. A competitor acquires a battery startup. Customer surveys show shifting sustainability preferences. Academic papers describe manufacturing breakthroughs. Policy changes in Europe affect data handling.

Which signals matter? Which demand response? Which threatens your strategy?

Without systematic filtering, environmental scanning produces analysis paralysis, false urgency, or strategic blindness. Teams identify opportunities and risks but cannot prioritize. They react to noise or miss critical shifts buried in information overload.

These five principles convert 500+ signals into 5 strategic bets backed by evidence and business impact analysis.

Principle 1: Filter by strategic priorities, not interesting topics

Define 3-5 strategic objectives before scanning. Every signal must answer: "If this is real, which priority does it accelerate, threaten, or invalidate?"

Cannot answer in 30 seconds? Eliminate it.

Most firms scan broadly, hoping patterns emerge. Define priorities first. Scan only what affects them. This eliminates 60-70% of signals immediately while focusing on external conditions that actually inform decision-making.

Principle 2: Validate through multiple independent sources

One mention is not relevant information. Require three independent confirmations before treating signals as actionable.

One source = noise. Two sources = echo chamber. Three independent sources = pattern.

Three articles citing the same study are one source, not three. Look for different geographies, industries, or methodologies reaching similar conclusions. This separates valuable insights from hype cycles.

Principle 3: Aggregate signals into higher-level patterns

Fifty signals about AI applications are noise. One pattern, such as "AI reduces industrial labor costs 20-35% across sectors", is actionable insight.

Most teams collect 200 developments without recognizing that they represent 5 industry trends. Aggregation transforms scattered external sources into coherent insights about your business environment.

Ask: What broader shift do these signals represent?

Principle 4: Quantify business impact, not just likelihood

Most environmental scanning reports describe what is changing. New customer behaviors emerge. Legal factors shift. Artificial intelligence startups launch breakthrough products.

This answers "what" but not "so what."

A 90% probable external opportunity with 2% impact does not deserve attention. A 30% probable trend with 40% revenue impact demands leadership attention immediately.

Quantify both dimensions:

High Impact + High Likelihood = Immediate strategic bet. Resource allocation now. This reshapes your business environment whether you act or not.

High Impact + Low Likelihood = Monitor closely, prepare contingencies. Build organizational readiness. If the probability increases, you move faster than your competitors.

Low Impact (regardless of likelihood) = Deprioritize. Your strategic planning process has higher-value opportunities demanding attention.

Principle 5: Connect insights to resource allocation and market timing

Insights without decisions are expensive research projects.

Every validated pattern from environmental scanning must answer four questions:

-

What changes? Which portfolio decision, product roadmap, or market entry?

-

What resources? Specific budget and headcount commitments?

-

When do we act? Decision timeline tied to market maturity?

-

Who decides? Clear ownership and accountability?

If you cannot answer all four, the insight is not ready for strategic decision-making. Return to validation or deprioritize.

Systematic filtering:

500+ signals → Filter priorities → 150 relevant → Validate sources → 50 confirmed → Aggregate patterns → 15 insights → Quantify impact → 8 high-impact → Resource + timing → 5 strategic bets

This is how organizations build strategic foresight while competitors organize data.

3 modes of environmental scanning: From broad scanning to focused monitoring

Environment scanning is not one-size-fits-all. Organizations choose different modes based on their goals, uncertainty levels, and resources. The three primary modes (scanning, scouting, and monitoring) each serve distinct roles in identifying and analyzing changes in the internal and external environment for strategic planning (Exhibit 2).

/the-3-types-of-environment-scans.webp?width=966&height=544&name=the-3-types-of-environment-scans.webp)

Exhibit 2: The 3 modes of environmental scanning

Scanning: Broad search for relevant data

Scanning involves a wide-angle, proactive search of the environment to detect weak signals and early-stage trends. It covers diverse sources, e.g., scientific publications, market reports, expert insights, and startup ecosystems, to capture new and potentially impactful information.

Scanning is often more superficial and broader, making it essential for organizations to anticipate disruptive shifts and gain a competitive edge in adjacent horizons.

Scouting: Deep-dive research on specific topics

Scouting is a focused, in-depth investigation of specific technologies, trends, or market shifts.

Often called trend or technology scouting, it helps teams assess feasibility, market readiness, and potential impact.

Methods like focus groups, expert interviews, and surveys gather diverse perspectives to identify patterns and inform innovation strategies and strategic planning.

Monitoring: Staying alerted on known trends

Monitoring is a structured, ongoing follow-up of established trends, technologies, or market developments. It tracks updates from trusted sources, competitor moves, and evolving customer attitudes. Monitoring enables organizations to assess the evolution of trends and adjust strategic objectives in response to market changes and emerging risks.

A balanced environmental scanning approach integrates all three modes. Scanning broadens awareness of new trends, scouting deepens understanding, and monitoring ensures continuous alignment with the external environment. Together, they help organizations stay informed, adaptable, and strategically prepared for future opportunities and threats.

3 frameworks to model your corporate environment

A structured approach to environmental scanning helps organizations navigate external complexities and develop forward-looking strategies. Proven frameworks enable businesses to categorize, analyze, and interpret external forces, ensuring they stay competitive and innovative.

PESTLE Analysis: A holistic classification of external factors

PESTLE, or STEEP, analysis (Social, Technological, Economic, Environmental, and Political) is a mutually exclusive, collectively exhaustive framework that provides a comprehensive assessment of external factors along the following categories:

-

Social: Demographic changes, consumer behaviors, market sentiment

-

Technological: Emerging technologies, artificial intelligence, digital tools

-

Economic: Market cycles, inflation, trade policies, stock market

-

Environmental: Climate change, sustainability regulations

-

Political: Government policies, international relations, legislative changes

This framework is invaluable in environmental scanning, allowing teams to assess all perspectives influencing decisions (Exhibit 3).

/STEEP-framework.webp?width=966&height=544&name=STEEP-framework.webp)

Exhibit 3: The STEEP framework

SWOT Analysis: Integrating internal and external factors for strategic foresight

SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) combines in-house capabilities with external realities. Unlike STEEP, which focuses solely on external factors, SWOT helps organizations assess how external developments interact with internal strengths and vulnerabilities.

-

Strengths & Weaknesses (Internal): Competitive advantages, operational inefficiencies, core capabilities

-

Opportunities & Threats (External): Market trends, technological advancements, regulatory changes

By blending external scanning with internal reflection, SWOT ensures alignment of innovation strategies with potential opportunities and risks (Exhibit 4).

/SWOT-analysis.webp?width=966&height=460&name=SWOT-analysis.webp)

Exhibit 4: The SWOT analysis

Value Chain Analysis: Innovation process-oriented environmental modeling

Value chain analysis helps organizations map out their activities and identify areas of competitive advantage by evaluating both operations and external influences. It breaks down business workflows into primary (e.g., production, distribution) and support activities (e.g., HR, R&D, procurement) to analyze how external factors impact efficiency and innovation.

By applying environmental scanning to each stage of the value chain (Exhibit 5), companies can identify:

-

Where external pressures create bottlenecks

-

Where technological advancements can improve efficiency

-

How sustainability trends affect supply chains and production

/value-chain-analysis.webp?width=966&height=432&name=value-chain-analysis.webp)

Exhibit 5: The value chain analysis

Choosing the right framework

Each framework serves a different purpose. STEEP ensures broad external awareness. SWOT links external factors to internal realities. The value chain framework focuses on process efficiency. Using them together enables organizations to build a dynamic, future-proof strategy that adapts to external changes while leveraging internal strengths by systematically surveying and interpreting relevant data.

5 steps of an effective environmental scanning process

Environmental scanning is a systematic approach to identifying and analyzing emerging trends, weak signals, and future uncertainties (Exhibit 6). It helps organizations anticipate changes before they become disruptive, ensuring they stay ahead of market shifts and technological breakthroughs.

/environmental-scanning-team.webp?width=966&height=196&name=environmental-scanning-team.webp)

Exhibit 6: The steps of the best horizon scanning process

A well-structured environmental scanning process consists of five key steps that guide teams from exploration to strategic action.

1. Define the scope and objectives

The first step in horizon scanning is to clearly define the focus area. This includes setting objectives, identifying key themes (e.g., technology, regulation, consumer behavior), and determining the time horizon (short-term vs. long-term). Without a clear scope, scanning efforts can become unfocused, leading to information overload instead of actionable insights.

To ensure structured analysis, organizations should define an analysis framework from the outset. Popular frameworks include STEEP analysis (Social, Technological, Economic, Environmental, Political), SWOT (Strengths, Weaknesses, Opportunities, Threats), or trend radars that map signals based on their impact and timeframe. A well-defined framework helps prioritize and categorize findings effectively.

Organizations should also consider who will use the insights—whether it's leadership, product teams, or R&D—so the scanning process aligns with business needs.

2. Gather and identify signals and emerging trends

Once the scope is set, the next step is to collect weak signals, trends, and emerging patterns. This requires sourcing information gathered from a diverse range of channels, including:

-

Industry reports and research papers (OECD, World Economic Forum, McKinsey, Gartner)

-

Expert interviews and think tanks (MIT Technology Review, Brookings Institution, RAND Corporation)

-

Startup ecosystems and patent filings (Crunchbase, WIPO, tech accelerators)

-

News media and social discourse (Harvard Business Review, Wired, major financial publications)

-

Government and regulatory bodies (EU Commission, IEA, UN reports)

Involving key stakeholders in the data collection process is essential for enriching research efforts, particularly when conducting interviews or surveys to close knowledge gaps.

To avoid misinformation, organizations should define a list of trustworthy sources in advance, ensuring that only credible, well-researched, and industry-relevant insights are considered.

Unlike traditional market research, environmental scanning focuses on the fringes—looking for early indicators of change before they become mainstream.

3. Analyze and prioritize findings

Not all signals are equally important. The next step is to analyze and categorize the collected data, separating weak signals from hype and identifying the most strategically relevant trends.

Organizations often use their predefined analysis framework to map signals in a structured manner. Prioritization involves assessing:

-

Impact (How disruptive is the trend?)

-

Likelihood (How probable is its emergence?)

-

Timeframe (When is it likely to materialize?)

4. Connect insights to business needs

Environmental scanning is only valuable if insights lead to action. At this stage, findings are translated into strategic recommendations and linked to business opportunities, risks, and innovation roadmaps for all relevant stakeholders.

This step requires cross-functional collaboration, ensuring insights are integrated into decision-making rather than existing in isolation. Companies can use scenario planning to explore how different trends might interact and shape the future, enhancing strategic planning.

5. Continuously monitor and update insights

Environmental scanning is not a one-time process—it requires constant monitoring and iteration. As trends evolve, businesses must stay adaptable by updating their scanning process, refining focus areas, and validating assumptions over time.

By embedding horizon scanning into ongoing strategy development, organizations can ensure they remain resilient, proactive, and future-ready.

Digital tools that scale environmental scanning

Environmental scanning is most effective when structured with the right frameworks, processes, and analytical tools. These tools help organize information, assess relevance, and translate insights into strategic action. Effective strategic thinking is crucial in using these tools to adapt to complex and uncertain future scenarios. Below are some of the most valuable tools for an effective scanning process.

1. Trend radars to connect signals with strategic relevance

Trend and technology radars help visualize emerging trends, technologies, and market shifts based on their impact and timeframe. By categorizing signals into core, adjacent, and peripheral fields, organizations can prioritize developments and align them with their strategic goals (Exhibit 7).

Exhibit 7: Understanding the trends' speed of change

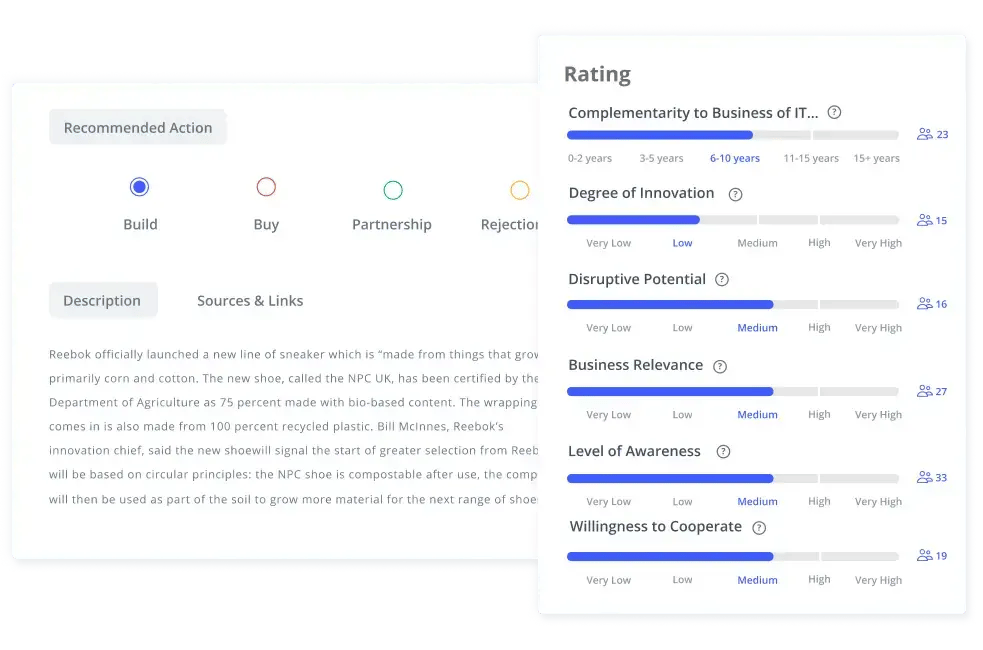

2. Collaborative workflows to prioritize insights with expert input

Not all trends and signals carry the same weight. A collaborative rating system allows teams to score environmental scans based on criteria like disruptiveness, feasibility, and urgency. This crowdsourced approach removes bias and strengthens decision-making (Exhibit 8).

Exhibit 8: Configurable rating criteria allow for every organization's strategy and terminology

3. Artificial intelligence powering a continuous process of signal scouting

AI-driven environmental scanning can automate trend detection by scanning news, research, and patents in real-time (Exhibit 9). This reduces manual effort and ensures organizations capture weak signals early.

/Still%20images/Element%20Mockups%202025/foresight-stay-in-the-loop-2025.webp?width=2160&height=1350&name=foresight-stay-in-the-loop-2025.webp)

Exhibit 9: ITONICS Prism provides context and receives relevant trends and inspirations.

4. Tailored reports for business leaders delivering actionable environmental scans

Environmental scanning should not operate in isolation. Creating customized dashboards for different business units ensures that relevant insights reach decision-makers in a format they can act on. These reports can highlight market shifts, competitive intelligence, and emerging risks, aligning foresight with business goals.

Using these tools together ensures a systematic and future-ready scanning process that translates environmental scans into actionable strategies.

Get from hundreds of signals to informed strategic decisions with ITONICS

The ITONICS Innovation OS provides you with the most interactive and widely used radar views. ITONICS is the only market intelligence software that seamlessly connects your environmental scanning activities with ideation and project portfolio management, enabling business leaders to gain insights and make informed decisions.

/Still%20images/Radar%20Mockups%202025/capability-views-ease-multi-criteria-decisions-2025.webp?width=2160&height=1350&name=capability-views-ease-multi-criteria-decisions-2025.webp)

Exhibit 10: A trend radar, highlighting the impact of the trend convergence of AI

Centralize scouting intel: Gathering insights from diverse external sources, such as industry publications, market reports, and customer feedback, is often inefficient. ITONICS centralizes scouting in one platform, allowing you to organize data on startups, technologies, and trends in interactive radars, making it easy to collaborate, identify patterns, and maintain a competitive edge.

Build engaging reports: Transform your environmental scanning efforts into actionable insights with customizable, data-driven reports in ITONICS. Export your results into PowerPoint, embed interactive radars on webpages, or sync your data with digital tools like Power BI or Tableau, supporting strategic decision making.

Automate opportunity discovery: Manually tracking and evaluating new opportunities takes time and resources. ITONICS automates opportunity discovery using artificial intelligence, keeping you up to date with the latest political, economic, social, technological, environmental, and legal factors. This ensures you stay ahead of industry trends, regulatory changes, and emerging risks, providing valuable insights for your innovation strategies and strategic planning process.

FAQs on environmental scanning

How often should we conduct environmental scanning activities?

Effective environmental scanning runs continuously, not periodically. Signal collection should happen daily or weekly through automated feeds and monitoring tools. Assessment and evaluation happen biweekly or monthly; your team reviews incoming signals, tags them, and scores relevance. Strategic synthesis occurs quarterly, where validated signals feed directly into portfolio reviews and resource allocation decisions.

The mistake most organizations make is treating scanning like an annual strategy off-site. By the time you reconvene, the environment has already shifted. Continuous scanning lets you spot inflection points early (regulatory changes, technology breakthroughs, competitive moves) when you still have time to adjust your portfolio rather than react to consequences.

What are the most common environmental scanning tools - with pros and cons?

Patent Databases (Espacenet, PatSnap, Orbit) Pros: Objective technology indicators, global coverage, early signal of R&D direction Cons: 18-month publication lag, requires IP expertise to interpret, misses non-patented innovations

Innovation Platforms (ITONICS) Pros: Structured signal collection, visual prioritization, connects scanning to portfolio decisions Cons: Requires ongoing commitment, effectiveness depends on consistent use and search queries

Scientific Literature Monitoring (Web of Science, PubMed, Google Scholar) Pros: Academic rigor, early-stage technology signals, identifies emerging research directions Cons: High volume, research-to-market lag of 5-10 years, often too early-stage for immediate action

Startup Tracking (Crunchbase, Tracxn, PitchBook) Pros: Market validation signals, identifies disruption patterns, shows where venture capital is flowing Cons: Biased toward funded companies, misses bootstrapped innovation, startup failure rates create noise

Regulatory Intelligence (PolicyWatch, RegData, industry-specific services) Pros: Directly actionable, clear impact on market access, predictable timelines Cons: Jurisdiction-specific, requires legal interpretation, often reactive rather than predictive

News Aggregators (Feedly, Meltwater, Moreover) Pros: Broad coverage, real-time updates, captures weak signals across categories Cons: Signal-to-noise ratio is poor, requires heavy filtering, trends toward hype over substance

Most effective organizations use a core platform like ITONICS and plug-in additional capabilities as needed.

How do you prevent information overload when scanning the business environment?

Start with strategic questions, not broad monitoring. Define 3-5 specific questions your scanning needs to answer: "What could make our current product pipeline obsolete?" or "Which adjacent markets should we enter in the next three years?" Every signal gets filtered through these lenses; if it doesn't help answer a strategic question, stop tracking it.

Use structured evaluation frameworks to triage quickly. Score signals on two dimensions: potential impact on your portfolio and time to relevance. High impact + near-term signals get immediate attention. Low-impact or distant signals get archived. This 2x2 matrix takes 30 seconds per signal and prevents analysis paralysis.

Set collection limits. Monitor 10-15 high-quality sources rather than 100 mediocre ones. Use tools that aggregate and deduplicate automatically. Schedule specific times for signal review. Daily monitoring creates reactive firefighting, while quarterly reviews miss inflection points. Biweekly synthesis strikes the right balance.

Most importantly: connect scanning directly to decisions. If your environmental scanning insights live in reports that nobody reads, you've created information theater, not strategic intelligence. Signals should feed directly into portfolio reviews, project funding decisions, and capability development planning. When scanning influences decisions, the team naturally focuses on what matters and ignores noise.

What is a quick test to tell whether a signal is relevant or not?

Ask three questions in sequence:

1. "Could this change what we fund, build, or stop?" If a signal can't influence portfolio allocation, project prioritization, or capability investment, it's noise. Interesting trends that don't affect decisions are curiosities, not strategic intelligence.

2. "Do we have time to respond?" Signals about changes happening next month are too late; you're reacting, not anticipating. Signals 10+ years out are too early; uncertainty is too high to act. The sweet spot is 12-36 months: far enough to prepare, near enough to validate.

3. "Is this directionally clear or still ambiguous?" If a technology, regulation, or market trend has reached "directional clarity", meaning the trajectory is becoming obvious even if details are uncertain, it's relevant. If five credible sources point in the same direction, that's a signal. If it's one speculative article, that's noise.

Fast version: "Portfolio impact + actionable timeframe + directional clarity = relevant signal." If any element is missing, archive it or wait for more data.

Who should own environmental scanning?

Environmental scanning requires three distinct roles, and failure usually happens when one person or team tries to own all three:

Signal Collection: Distributed across the organization. R&D engineers track technical publications. Product managers monitor customer needs. Strategy teams watch market shifts. Centralized collection creates bottlenecks and misses domain expertise. Use tools that let multiple contributors feed signals into one system.

Signal Curation: Owned by a dedicated function, typically Strategy, Portfolio Management, or Innovation teams. This team validates signals, removes duplicates, assesses relevance using structured frameworks, and maintains the scanning process. They don't need to be experts in every domain, but they need authority to say "this matters" or "this doesn't."

Strategic Synthesis: Owned by portfolio leadership - whoever makes funding and resource allocation decisions. They consume curated signals during portfolio reviews and translate insights into portfolio adjustments. Scanning fails when it stays with curators and never reaches decision-makers.

The critical mistake: assigning environmental scanning to someone without decision authority. When Strategy creates scanning reports that Portfolio Managers ignore, you've built information theater. The curator role should report directly to whoever controls the portfolio, ensuring signals connect to decisions.

In practice: Portfolio Manager owns outcomes, Strategy/Innovation owns curation process, domain experts contribute signals. Clarity on these three roles prevents both bottlenecks (one person doing everything) and disconnection (scanning that never influences decisions).

/How-to-Use-Environmental-Scanning-in-Your-Innovation-Journey-fullwidth.webp?width=1920&height=450&name=How-to-Use-Environmental-Scanning-in-Your-Innovation-Journey-fullwidth.webp)